What Investors Should Know About the s and p 500

Introduction: Why the s and p 500 matters

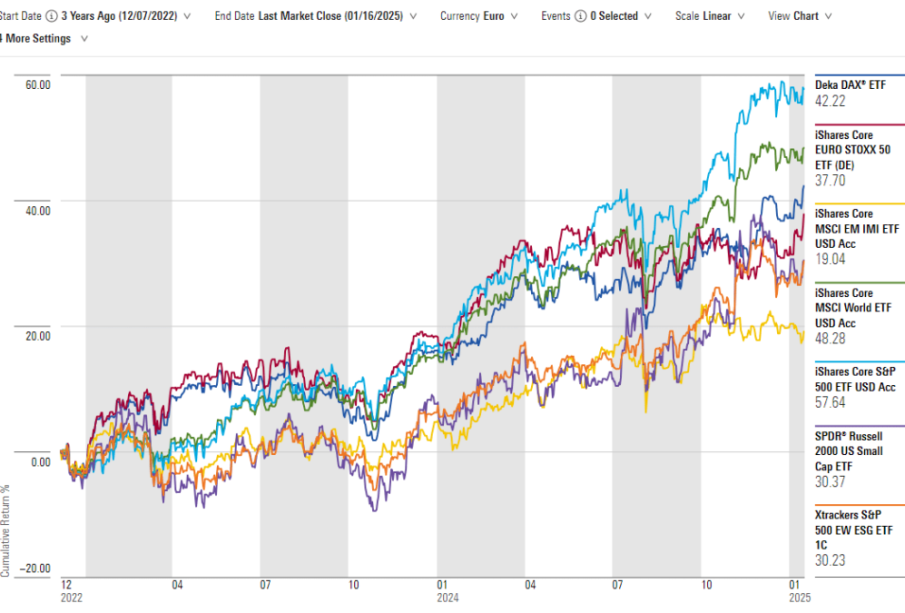

The s and p 500 is one of the most widely followed equity indices globally, serving as a barometer for the performance of large-cap US companies. For investors, policymakers and savers around the world, movements in the s and p 500 offer a snapshot of market sentiment, economic expectations and corporate health. Its relevance extends beyond the United States — it influences global asset allocation, retirement funds and market-linked products.

What the index represents

The s and p 500 tracks 500 large-cap companies across a broad range of industries. It is maintained by a major index provider and uses market-capitalisation weighting, which means larger companies have a proportionally greater influence on the index’s performance. Because the index covers multiple sectors, it is commonly used as a benchmark for US equity market performance and as the basis for index funds and exchange-traded funds that aim to replicate its returns.

How investors use the s and p 500

Investors use the s and p 500 for several purposes: as a performance benchmark for active managers, as a core holding in diversified portfolios, and as the foundation for passive investment strategies. The index’s broad composition and deep liquidity make it a favoured reference point for measuring risk-adjusted returns. Many retirement funds and institutional mandates compare their performance against the s and p 500 to assess manager skill and strategic allocation decisions.

Factors that influence the index

Movements in the s and p 500 are driven by corporate earnings, interest rate expectations, inflation data, geopolitical developments and broader economic indicators such as employment and consumer demand. Market volatility can increase when investors reassess these inputs, while sustained trends in earnings growth or monetary policy tend to support longer-term movements. Because the index is market-cap weighted, developments affecting the largest constituents often have outsized effects on headline performance.

Conclusion: Implications for readers

For individual and institutional investors, keeping track of the s and p 500 helps in understanding broader market trends and in making informed allocation decisions. While short-term swings are common, the index remains a central tool for assessing the health of large-cap US equities and for constructing diversified portfolios. Readers should consider the s and p 500 as one of several tools — alongside economic data, sector analysis and personal investment goals — when evaluating market conditions and planning their investment strategy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.