Understanding interest rates: impact on loans and savings

Introduction: Why interest rates matter

Interest rates are a central feature of modern finance and affect everyday decisions for households, businesses and investors. An interest rate is the percentage of interest relative to the principal—either what lenders charge borrowers or what is earned from deposits. Understanding interest rates is important for budgeting, choosing loan products, and planning savings.

Main details: Types, benchmarks and mortgages

Basic definition and role

At its core, an interest rate expresses the cost of borrowing or the return on saving as a percentage of the principal amount. For borrowers, a higher interest rate increases the total cost of a loan. For depositors, a higher rate typically means better returns on savings.

Benchmark rates: the US federal funds rate

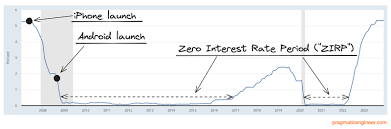

Benchmark rates guide many other interest rates across an economy. For example, the United States federal funds rate was last recorded at 3.75 percent. Historically, that rate averaged 5.40 percent from 1971, showing that benchmark rates can vary considerably over time and influence borrowing costs and financial conditions.

Mortgage interest rates and loan types

Mortgage interest rates are the percentage you pay to borrow money for a home loan and form part of the annual percentage rate (APR). Mortgage rates determine monthly payments and long-term interest costs. Common mortgage categories include 30‑ and 20‑year fixed-rate mortgages, government-insured loans such as FHA and VA loans, and jumbo mortgages for larger loan amounts. The interest rate component of the APR, together with fees and other costs, shapes the effective cost of a home loan.

Conclusion: What readers should take away

Interest rates directly influence affordability for borrowers and returns for savers. With the US federal funds rate last recorded at 3.75 percent and historical averages higher, monitoring interest rates helps households decide when to borrow, refinance or save. For mortgage seekers, understanding how interest rates feed into APRs and how loan types differ is essential. Staying informed about benchmark rates and comparing loan offers can reduce costs and improve financial planning.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.