Understanding BHP Share Price Trends and Market Influence

Introduction

The share price of BHP, one of the world’s largest mining companies, is a crucial indicator of market performance in the resources sector. Understanding the movements in BHP share price is essential for investors, analysts, and market enthusiasts alike, as it reflects broader economic trends and commodity demand, particularly in mining and natural resources.

Current BHP Share Price Status

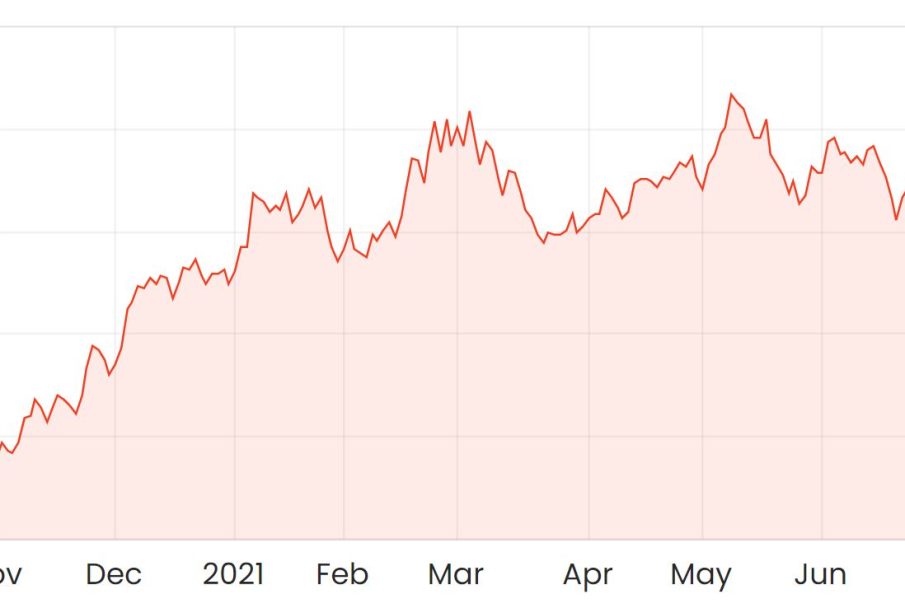

As of October 2023, BHP’s share price has experienced notable fluctuations, primarily driven by changes in commodity prices, global economic conditions, and geopolitical stability. Recent reports indicate that the share price has hovered around AUD 46.50, with analysts predicting a volatile trading period as investors respond to fluctuating iron ore prices and any changes in China’s economic policies, which significantly impact demand for BHP’s products.

Factors Influencing BHP Share Price

Several key factors are currently influencing the BHP share price:

- Commodity Prices: The prices for key commodities such as iron ore, copper, and nickel have a direct impact on BHP’s profitability and, consequently, its share price. Recent declines in iron ore prices have raised concerns among investors.

- Global Economic Conditions: Economic indicators from major markets, particularly China, the largest consumer of iron ore, play a significant role. Any signs of economic slowdown or growth can lead to immediate reassessments of BHP’s share value.

- Geopolitical Events: Issues such as trade tensions, sanctions, or changes in governmental policies in resource-rich countries can create uncertainty and volatility in the BHP share price.

Market Predictions

Looking forward, analysts expect continued volatility in the BHP share price, influenced by both internal corporate developments and external market forces. Predictions suggest cautious optimism, with potential for recovery should global economic indicators improve. However, the risk of downturn remains as commodity prices fluctuate.

Conclusion

For investors and stakeholders in the mining sector, monitoring the BHP share price is vital for making informed decisions. The interplay of commodity prices, global economic conditions, and geopolitical factors will continue to shape the future of BHP and its share price movements. As the market evolves, staying informed will be key for those looking to navigate the complexities of investing in major resource companies.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.