Understanding Average Superannuation Balances by Age in Australia

The Importance of Superannuation in Australia

Superannuation, often referred to as ‘super,’ is a vital component of retirement planning for Australians. It serves as a crucial source of income after individuals retire, ensuring that citizens have the financial security to sustain their lifestyle without relying heavily on the aged pension. Understanding the average superannuation balances by age can provide insights into how well Australians are preparing for their retirement years.

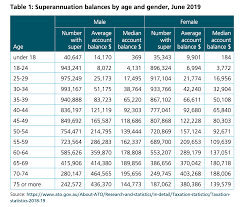

Current Average Balances According to Age

According to the latest data from the Australian Taxation Office (ATO) and industry reports, superannuation balances vary significantly across different age groups. As of 2023, these are the average balances:

- Ages 20-29: The average super balance is approximately $8,000.

- Ages 30-39: The average super balance increases to about $35,000.

- Ages 40-49: Average balances rise to around $90,000.

- Ages 50-59: The average balance reaches approximately $200,000.

- Ages 60 and above: Individuals in this group average about $300,000.

These figures indicate a growing trend where individuals approaching retirement have significantly larger balances compared to younger age cohorts, reflecting the importance of consistent contributions over the length of a working career.

Significance of These Balances

The disparity in superannuation balances by age has several implications. Firstly, it highlights the importance of starting super contributions early. Younger workers can take advantage of compound interest, which can dramatically increase their savings over time.

Moreover, the differences in average balances may also signify broader economic factors such as job stability, wage growth, and the impacts of economic downturns where younger workers may not have the same access to well-paying jobs or may fall into underemployment.

Future Implications and Planning

For younger Australians, understanding these statistics can motivate them to actively engage in their superannuation planning. Contributing more than the compulsory rate and staying informed about their funds options can lead to a more secure retirement. For older Australians, reviewing investment strategies or considering financial advice may enhance their retirement income.

As Australia continues to evolve regarding superannuation policy, including potential changes to contribution rates and government incentives, keeping an eye on these average balances will be essential for effective financial planning.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.