The Current State of the US Stock Market

Introduction

The US stock market plays a crucial role in the global economy, serving as a barometer for financial health and investor sentiment. As the largest stock market in the world, its movements can influence markets abroad and affect countless investors. In recent months, the US stock market has faced volatility due to inflation concerns, interest rate hikes, and geopolitical tensions, making it a relevant topic for current and potential investors.

Current Market Trends

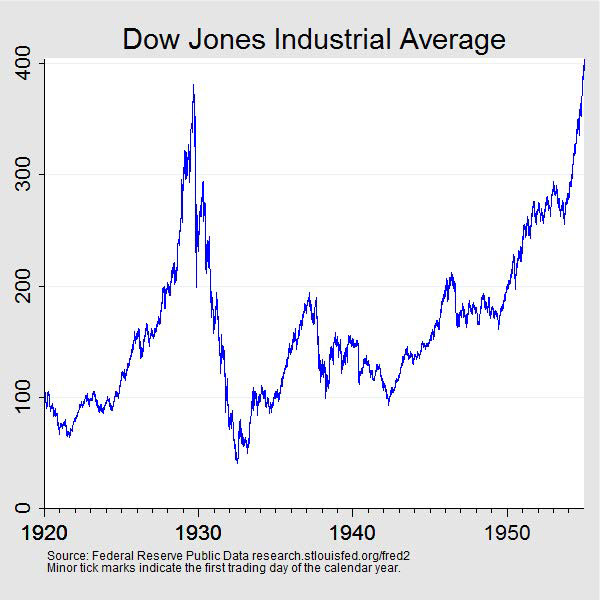

As of October 2023, the US stock market has exhibited mixed performance. Major indices like the Dow Jones Industrial Average and the S&P 500 have seen fluctuations, partially driven by ongoing inflation fears and the Federal Reserve’s monetary policy. The tech sector, which had been a leader in market gains for much of the past decade, has faced headwinds as interest rates rise, prompting investors to reassess risk and allocate funds more conservatively.

An influx of volatility can also be traced to corporate earnings reports, with several large companies reporting disappointing earnings, further weighing on market sentiment. Additionally, international factors such as the ongoing conflict in Ukraine and supply chain disruptions resulting from China’s regulatory actions continue to pose challenges.

Potential Implications for Investors

As fluctuations persist, investors are considering diversification strategies to mitigate risks. Financial experts advise keeping an eye on sector performance—defensive sectors like utilities and consumer staples have shown resilience in turbulent times. On the other hand, technology and discretionary spending may offer growth opportunities, albeit with greater risk.

Conclusions

The future of the US stock market remains uncertain, largely contingent on how economic indicators evolve. Analysts predict that if inflation rates stabilise and the Federal Reserve maintains a balanced approach to interest rates, market confidence could gradually return. Conversely, persistent inflation and geopolitical uncertainties could further complicate recovery efforts. For investors, keen awareness of market trends, combined with diversified portfolios, could prove integral in navigating the complexities of investing in the current economic landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.