NAB Banking Outage: What You Need to Know

Overview of the NAB Banking Outage

National Australia Bank (NAB) experienced a significant banking outage on October 24, 2023, disrupting services for thousands of customers across the country. The outage, which lasted several hours, affected online banking, ATM transactions, and customer service lines, causing frustration among account holders who rely heavily on digital banking.

Impact on Customers

The outage began around 9 AM AEDT, with numerous reports flooding social media as customers complained that they were unable to access their accounts or make transactions. NAB acknowledged the issue via their official Twitter account, stating that their technical teams were actively working to resolve the problem. By noon, services were gradually restored; however, many customers continued to face issues throughout the day.

Causes of the Outage

While NAB has not disclosed the specific reasons behind the outage, preliminary reports suggest that it could be linked to scheduled maintenance that did not go as planned. Industry experts have highlighted the challenges faced by large financial institutions in maintaining service reliability amidst increasing cyber threats and growing customer demands for seamless digital experiences.

Company Response

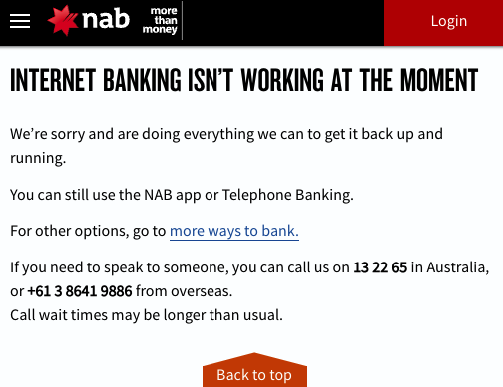

In a follow-up announcement, NAB’s management expressed regret for the inconvenience caused, stating, “We sincerely apologise for the disruption and understand the frustration this has caused our customers. We are reviewing our systems to prevent future occurrences.” The bank has also opened a dedicated support line for affected customers.

Broader Implications

This incident raises concerns about the reliability of banking infrastructure and the heavy dependency on digital platforms. As financial services become increasingly digitised, incidents like the NAB banking outage serve as a reminder of the potential vulnerabilities associated with online banking. Regulatory bodies may also consider further scrutiny on banks’ systems to ensure that customer interests are well protected.

Conclusion

The NAB banking outage of October 2023 has highlighted the challenges banks face in maintaining operational integrity in a digital-first world. As the situation develops, customers are encouraged to stay informed through official communication channels and exercise caution when engaging in online transactions. The bank’s pledge to reinforce its systems could yield longer-term benefits for customer trust and service reliability. NAB customers can expect improvements in future, but they should remain vigilant about the safeguards surrounding their online banking experience.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.