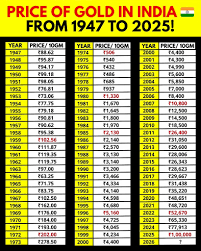

Latest gold price in india — 22K and 24K rates, market moves

Introduction: Why the gold price in india matters

Gold remains a key store of value and cultural asset in India, used for investment, jewellery and rituals. Monitoring the gold price in India is important for consumers, jewellers and investors making buy, sell or hedge decisions. Recent market moves and published rates from major sources give a snapshot of how local prices track global bullion and domestic demand.

Main developments and current figures

Published rate snapshots

Policybazaar’s listing of today’s gold rates references multiple weight units (1 gram up to 12 gram / 1 tola) and shows headline figures such as ₹1,70,390 and ₹1,64,640 in its rate table. These figures appear alongside standard 22‑carat and 24‑carat quotations commonly used in India.

Market moves reported by exchanges and press

Mint reports that MCX gold rose by around ₹3,000 per 10 grams in recent trading, a significant intraday move that reflects renewed global risk dynamics. Silver also jumped—reported at about ₹16,500 per kg—while some reports note silver crossing the ₹3 lakh per kg threshold during heightened volatility. Mint further noted a roughly 2% jump in gold prices at one point, taking bullion to fresh highs amid tariff and trade tensions and a softer dollar.

City and short‑term variation

Hindustan Times provides city‑level rate tables and short‑term graphs, showing that while global bullion can push rates up, local prices in different metros sometimes edge lower or vary slightly due to premiums, local demand and supply. Their coverage highlights 10‑gram quotes for 22‑carat and 24‑carat gold used by many retail buyers.

Factors shaping prices

Across reports, common drivers are cited: international bullion demand and supply, the US dollar and interest rates, geopolitical and trade tensions, MCX trading, import policies and local jeweller premiums. These factors explain why rates can move quickly and differ between cities and sellers.

Conclusion: What readers should take away

For buyers and sellers, the practical takeaway is to check multiple, up‑to‑date sources—financial portals, exchange (MCX) reports and your local jeweller—before transacting. Short‑term volatility can be large (for example, moves reported as ₹3,000 per 10g), while longer‑term direction depends on global macro drivers. Keeping an eye on day‑to‑day published rates and the factors above will help readers make more informed decisions about timing and pricing when dealing with gold in India.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.