Australian Stock Market Braces for ‘September Swoon’ as ASX 200 Tests Historic Highs

Market Overview and Recent Performance

The ASX 200, Australia’s benchmark index, recently experienced a decline to 8,739 points on September 3, 2025, dropping 1.82% in a single session. Despite this setback, the index has shown resilience with a 0.87% increase over the past month and an impressive 9.92% gain compared to the previous year.

Current Market Dynamics

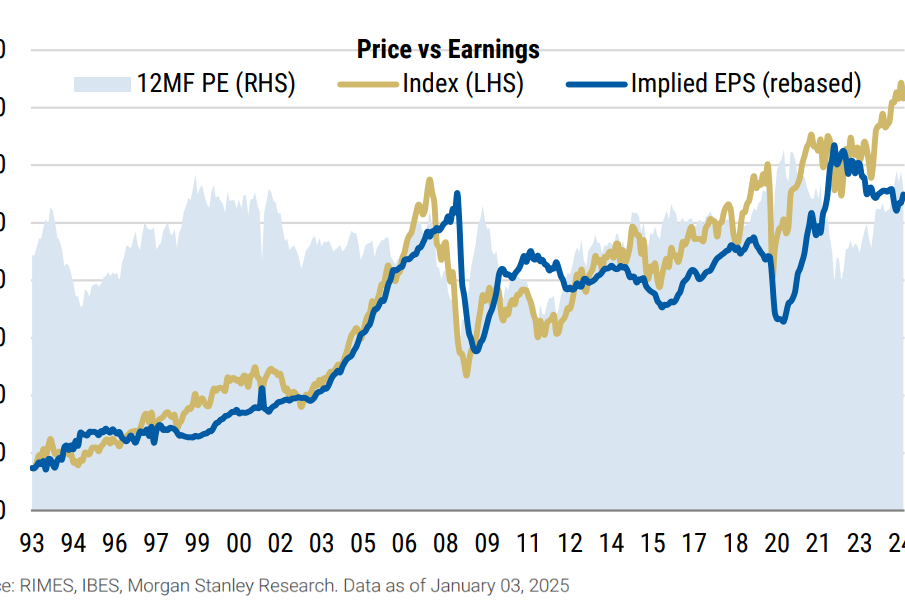

The market has been setting records, recently pushing past the 9,000 level while managing to overcome various challenges including elevated valuations, global trade uncertainty, weak commodity prices, and concerns about China’s economic slowdown.

Recent market activity shows continued pressure, with the S&P/ASX 200 experiencing significant declines, with widespread losses affecting all sectors, particularly banking and technology stocks.

September Challenges

Historical data spanning the last 40 years indicates that September has traditionally been a challenging month for the ASX 200, typically initiating a 12-week period of increased market volatility.

The ‘September Swoon’ phenomenon has become more pronounced in recent years, with data showing an average decline of 0.33% during September over the past 20 years, compared to a smaller decline of 0.11% over the 40-year average. This seasonal weakness has become more noticeable, particularly following the typically stronger July-August period.

Economic Indicators and Market Outlook

Current market challenges include ongoing difficulties in business pricing amid policy uncertainty, while bond yields remain a concern due to global fiscal pressures and political instability.

The S&P/ASX 200 remains Australia’s leading share market index, comprising the top 200 ASX listed companies by float-adjusted market capitalisation and representing approximately 79% of Australia’s equity market as of June 2025.

Investor Implications

For listed companies, inclusion in the ASX 200 carries significant importance as it attracts institutional interest, encourages investment, and often leads to increased research coverage by stockbroking firms and analysts. Long-term investors should note that historically, the index has delivered returns of 3.98% per annum excluding dividends, and 8.36% including dividends (as of June 2025).

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.