An Analysis of Meta Stock Performance in 2023

Importance of Monitoring Meta Stock

In today’s technology-driven economy, keeping a watchful eye on big tech companies is crucial for investors. Meta Platforms, Inc., previously known as Facebook, is one of the leading social media companies whose stock performance can significantly impact market trends and investor portfolios. The relevance of tracking Meta stock is heightened by its ongoing innovations, regulatory challenges, and competition in the tech landscape.

Recent Performance of Meta Stock

As of October 2023, Meta stock has seen significant fluctuations influenced by various factors. The company reported a positive earnings result in Q3 2023, with a revenue growth of 12%, driven primarily by its expanding advertising services and growth in the Reality Labs segment, focused on virtual and augmented realities. This news led to a noticeable uptick in the stock price, peaking at $325, a considerable rebound from earlier this year when the stock had dipped below $250 due to concerns over privacy regulations and competition from platforms like TikTok.

Key Challenges and Opportunities

Despite its growth, Meta faces challenges that could impact its stock in the future. Increasing regulatory scrutiny on data privacy and anti-competitive practices is a continuous burden on investor sentiment. Additionally, competition in digital advertising remains fierce. To combat these risks, Meta is investing heavily in new technologies, including AI and virtual reality, which could pivot its business model towards new revenue streams. Analysts suggest that successful execution of this pivot may further bolster the stock in the coming years.

Future Outlook for Investors

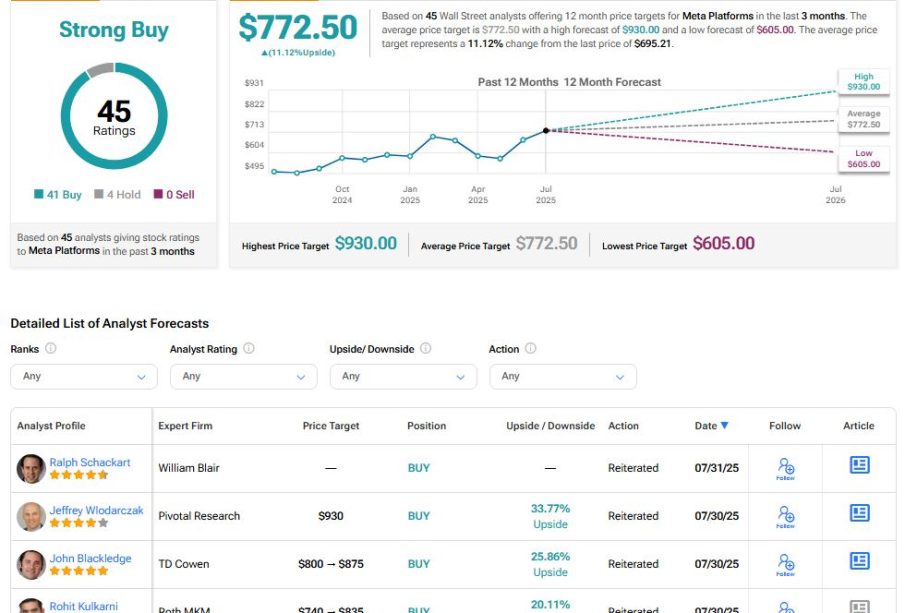

Looking forward, market analysts remain cautiously optimistic about Meta’s potential. Innovations in AI applications and enhancements in user engagement across its platforms could foster an environment for sustained growth. With a strong balance sheet and consistent cash flow, many analysts suggest a ‘buy’ recommendation for Meta stock, indicating potential for long-term gains for investors who can navigate the associated risks.

Conclusion

In summary, Meta stock remains a topic of significant interest for investors. While the company is poised for growth, the combination of regulatory challenges and competitive pressures must be closely monitored. Investors should stay informed about the latest developments, considering both the opportunities and risks associated with Meta’s business strategy. As the company continues to adapt to the evolving digital landscape, the stock performance in the coming quarters will be crucial for strategic investment decisions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.