The Importance of the S&P 500 Index in Today’s Market

Introduction

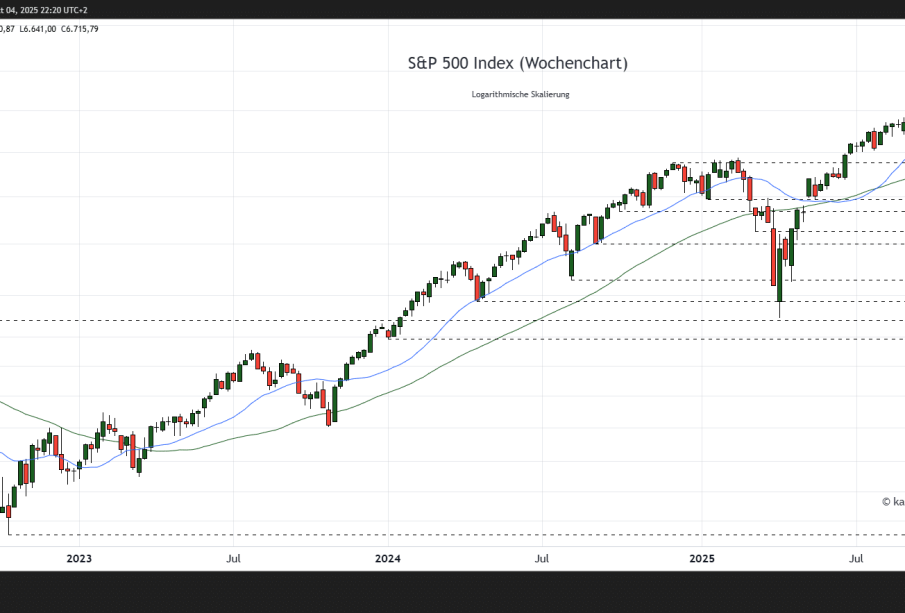

The S&P 500 Index, one of the most widely recognized benchmarks of U.S. stock market performance, is crucial for investors and financial analysts alike. Comprising 500 of the largest publicly traded companies in the United States, the index serves as an essential indicator of the overall health of the economy and the stock market. Understanding its movements and trends can offer insights into potential investment opportunities and economic forecasts.

Current Market Trends

As of October 2023, the S&P 500 has shown resilience amidst economic uncertainties. Recent reports indicate that the index has experienced an uptick of approximately 10% since the beginning of the year, fueled by strong earnings reported by several tech giants and a steady labour market. Analysts suggest that the positive momentum is further supported by a decrease in inflation rates, which has led to increased consumer spending.

In September, the Federal Reserve’s decision to maintain interest rates has also played a role in stabilising investor confidence. This has been particularly beneficial for sectors like technology and consumer discretionary, which heavily influence the S&P 500 index.

Sector Performance

A closer look at the sectors within the S&P 500 reveals that technology stocks are leading the charge, with companies like Apple and Microsoft reporting better-than-expected quarterly earnings. Additionally, the healthcare and energy sectors have also seen significant advancements, contributing to the overall strength of the index.

However, not all sectors are faring equally. The telecommunications and utilities sectors have encountered challenges, mostly due to regulatory pressures and shifts in consumer demand. Investors are advised to remain observant of these trends when considering portfolio allocations.

Conclusion

The S&P 500 index is not merely a number; it reflects the economic landscape and investor sentiment in the U.S. market. As we move into the final quarter of the year, analysts predict continued volatility but remain optimistic about the potential for growth, especially in technology. Investors are encouraged to stay informed about developments affecting the index, as these can significantly influence market strategies and personal investments. Understanding the dynamics of the S&P 500 will undoubtedly provide a competitive edge for anyone navigating the complexities of the stock market.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.