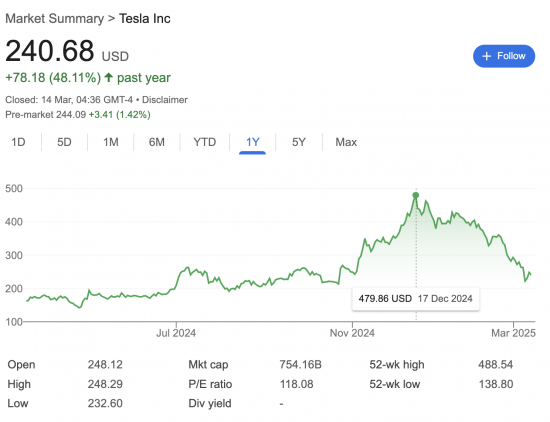

Current Trends and Future Predictions for Tesla Share Price

Introduction

The Tesla share price has become a focal point for investors and market analysts alike, reflecting the company’s pivotal role in the electric vehicle (EV) sector. As one of the leading companies in innovative tech and sustainable energy solutions, Tesla’s stock performance can significantly influence investor sentiment and market trends worldwide. Understanding the factors that affect Tesla’s share price is essential for both potential and current investors looking to make informed decisions amidst the volatile landscape of tech stocks.

Recent Performance and Influencing Factors

As of October 2023, Tesla shares are trading at around AUD 130, showing a considerable rise from earlier this year when the stock was approximately AUD 100. This upward movement is attributed to a combination of strong quarterly earnings reports and expanding production capabilities, particularly in new markets such as India and Europe.

Additionally, Tesla’s recent announcements regarding the launch of the Cybertruck, along with its advancements in battery technology, have injected optimism into the market. Analysts suggest that these developments not only solidify Tesla’s position as a leader in the EV market but may also potentially lead to higher sales targets being met, which in turn can positively impact share price.

Challenges Ahead

Despite the positive outlook, Tesla must navigate several challenges that could impact its stock performance. Competitive pressure is on the rise, with traditional automotive giants and new entrants ramping up their EV production, which could result in market share erosion. Moreover, supply chain disruptions, particularly concerning semiconductor shortages, have the potential to hinder production and delivery capabilities.

In addition, macroeconomic factors such as inflation and fluctuating interest rates pose risks to the broader market. Investors are closely monitoring these economic indicators, as they could lead to increased volatility in Tesla’s share price.

Conclusion and Predictions

Looking forward, Tesla’s share price is expected to remain subject to both internal company developments and external market conditions. Analysts predict that as the demand for EVs continues to surge and if Tesla can maintain its competitive edge, the stock could see further gains in the coming months. However, investors are advised to stay informed about both technological advancements and market challenges that could impact stock prices.

In a rapidly changing industry, the Tesla share price will not only reflect the company’s financial health but also underscore the transition towards sustainable energy and transportation solutions globally. For investors, staying abreast of these trends will be crucial for navigating their investment strategies effectively.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.