Current Trends on Nvidia Share Price: What Investors Need to Know

Introduction

Nvidia Corporation, a leading technology company known for its graphics processing units (GPUs), has seen its share price fluctuate significantly in recent months. Its relevance extends beyond just the tech industry, affecting stock markets globally due to its critical role in advancements like artificial intelligence (AI) and gaming technology. Understanding the dynamics of Nvidia’s share price is crucial for investors and market analysts alike, especially given the company’s pivotal position in the semiconductor industry.

Nvidia’s Recent Performance

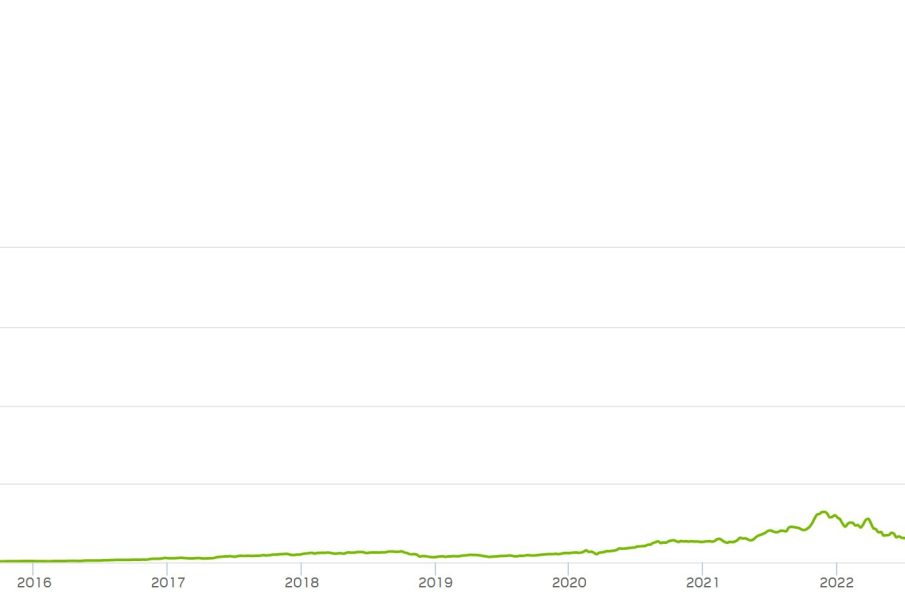

As of mid-October 2023, Nvidia’s share price has been on a rollercoaster ride. After reaching an all-time high of over AUD 600 per share in August, the price has dropped to around AUD 500, highlighting the volatility associated with tech stocks. Analysts attribute this decline to a combination of broader market corrections and specific concerns about the company’s quarterly earnings report in November, which is expected to shape investor sentiment going into the holiday season.

Factors Influencing the Share Price

Numerous factors are influencing Nvidia’s current share price. The demand for AI technology is one such driver, with companies globally investing heavily in AI capabilities. Recent announcements from major corporations, including tech giants, about AI partnerships have put pressure on Nvidia to maintain its leading position. Meanwhile, ongoing supply chain challenges and geopolitical tensions in key markets such as China could also impact production and sales revenue.

The release of new products, particularly in gaming and data centres, is another key factor. Nvidia’s recent unveiling of its next-generation GPUs aimed at both gamers and professionals has generated buzz but also raised concerns among investors regarding the production costs and market saturation.

Conclusion

Looking ahead, analysts remain cautiously optimistic about Nvidia’s share price trajectory. With strong fundamentals and leadership in the burgeoning AI sector, Nvidia is well-positioned for long-term growth, although short-term fluctuations are likely. Investors should monitor upcoming financial results and market sentiments closely, as these will provide valuable insights into the company’s future performance. As Nvidia continues to innovate and adapt to market demands, its share price will undoubtedly remain a focus for both seasoned and new investors alike.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.