What Drives the BHP Share Price?

Introduction

The BHP share price is closely watched by investors, pension funds and market analysts in Australia and globally. As one of the world’s largest diversified miners, movements in BHP’s stock reflect broader trends in commodity markets, global growth expectations and corporate returns to shareholders. Understanding why the BHP share price moves matters for investors assessing portfolio exposure to resources, and for communities and economies tied to mining revenues.

Main body

Key drivers of the BHP share price

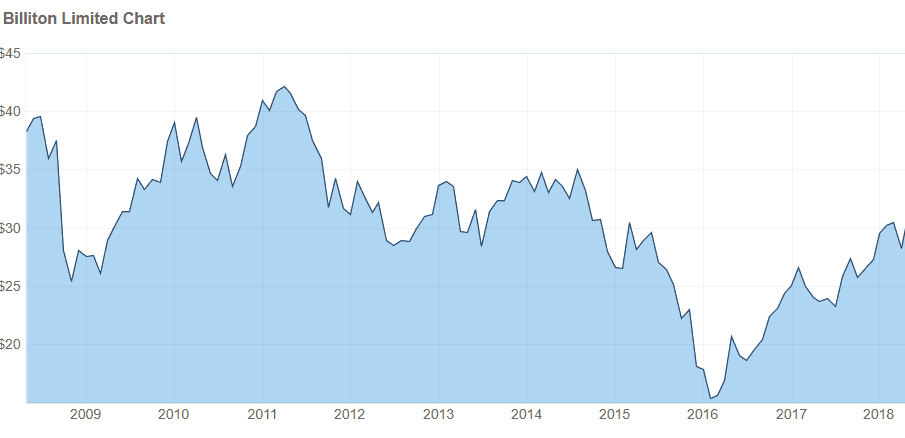

Commodity prices are a primary influence. BHP’s earnings and cash flow track prices for iron ore, copper, metallurgical coal, and petroleum to varying degrees. When commodity prices rise, revenues and profit margins tend to improve, supporting the BHP share price; the opposite occurs when prices fall.

Operational performance and portfolio mix

Production levels, cost control, and project delivery affect market sentiment. Performance at major assets, progress on expansions or divestments, and changes to the company’s portfolio (for example, shifts between bulk commodities and base metals) can change investor expectations and therefore the share price.

Macroeconomic and currency factors

Global economic growth—particularly in major consumers such as China—affects demand for raw materials. Exchange rates, especially the Australian dollar and US dollar movements, also influence the translated value of earnings and investor preference between domestic and international assets.

Corporate returns and capital management

Dividends, buybacks and balance-sheet policy are central to valuation. Clear, sustainable dividend policies and credible capital allocation plans can support the share price by attracting income-focused investors.

External risks and ESG considerations

Regulatory changes, geopolitical tensions, supply disruptions and environmental, social and governance (ESG) concerns can all affect investor sentiment. Increasing focus on decarbonisation and responsible mining practices influences long-term valuation models.

Conclusion

The BHP share price reflects a complex mix of commodity markets, operational outcomes, macroeconomic conditions and corporate policy. For investors, assessing BHP requires monitoring commodity cycles, production guidance and capital returns, while accounting for broader economic and ESG risks. While short-term volatility is common, long-term perspectives typically hinge on demand for the commodities BHP produces and the company’s ability to execute its strategy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.