Understanding the VIX Index: The Market’s Fear Gauge

Introduction

The VIX Index, also known as the Volatility Index, is a crucial financial metric that measures market expectations of volatility over the coming 30 days. Often referred to as the ‘fear gauge’, the VIX is a barometer for investors, providing insights into market sentiment and potential price movements. Its importance has only grown amid recent economic uncertainties, geopolitical tensions, and fluctuating financial markets. Understanding how the VIX operates and impacts investment strategies is essential for both seasoned traders and novice investors alike.

What is the VIX?

The VIX is calculated based on the prices of options on the S&P 500 Index (SPX). It reflects the implied volatility of a basket of S&P 500 options, which can be viewed as a forecast of future market movements. When the VIX is high, it suggests that investors expect significant price swings, either up or down. Conversely, a low VIX indicates that investors anticipate minimal fluctuations, often correlating with stable or bullish market conditions.

Recent Trends and Events

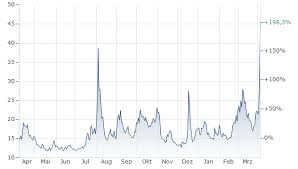

As of October 2023, the VIX has experienced notable fluctuations. Earlier this year, the index spiked following concerns in the banking sector and geopolitical events, including tensions in Eastern Europe and trade disputes in Asia. In contrast, during the summer months, the VIX saw a decline as investor confidence grew with the easing of inflationary pressures and strong corporate earnings reports.

According to financial analysts, the VIX reached a peak of 30 in March due to heightened fears stemming from the Silicon Valley Bank collapse, reflecting a market in panic. However, as the Federal Reserve indicated possible interest rate stabilisation, the VIX dropped back to below 20 in August, suggesting a return to more stable investor sentiment.

Implications for Investors

Investors can use the VIX as a tool for making informed decisions. A rising VIX can signal a good time to hedge against possible downturns in the market. Conversely, a declining VIX may indicate a suitable time for investment, as it suggests stability and lower risk. Moreover, many investors trade VIX-related products, including ETFs and options, to profit from fluctuations in volatility.

Conclusion

The VIX Index remains a crucial indicator in financial markets, encompassing the collective sentiment of investors about future volatility. As we move towards the final quarter of 2023, understanding the movements of the VIX will be vital in navigating potential market upheavals. Investors should maintain a close watch on the VIX, utilising it not only as a risk management tool but also as an integral part of their overall investment strategy. As economic conditions evolve, the VIX will continue to play a pivotal role in shaping market dynamics.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.