Understanding the S&P 500: Trends and Insights

Introduction

The S&P 500, often regarded as a barometer of the U.S. stock market’s health, comprises 500 of the largest publicly traded companies in the United States. Its performance is closely watched by investors and analysts alike, serving as a key indicator of overall economic performance and market trends. As of October 2023, understanding the updated dynamics of the S&P 500 is crucial for both long-term and short-term investors navigating an ever-changing financial landscape.

Recent Performance Trends

As of the end of September 2023, the S&P 500 has demonstrated considerable volatility, reflecting a somewhat mixed economic outlook. Following a robust recovery that began in early 2023, the index slightly retreated due to a hotter-than-expected inflation reading which raised concerns over the ongoing tightening of monetary policy by the Federal Reserve. The index’s performance has been impacted by key sectors including technology, healthcare, and consumer discretionary, which have been particularly sensitive to shifts in interest rates.

Key Influencing Factors

Several factors are currently influencing the S&P 500’s trajectory:

- Interest Rates: With the Federal Reserve’s recent policy decisions, including interest rate hikes to combat inflation, market analysts are closely monitoring their effects on corporate earnings and consumer spending.

- Corporate Earnings: Earnings reports from major S&P 500 companies have shown resilience, yet concerns over future guidance have emerged due to rising costs and supply chain issues, causing mixed investor sentiment.

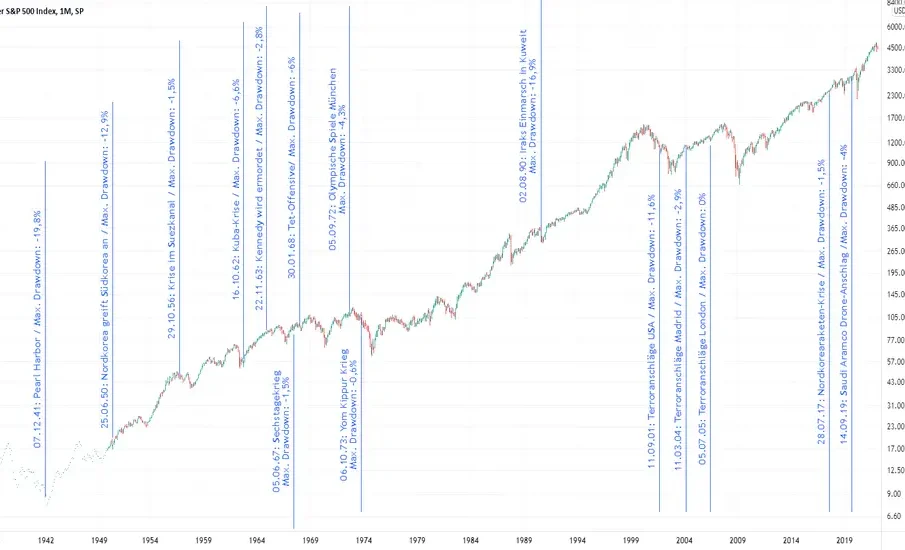

- Global Economic Concerns: Events such as geopolitical tensions, especially in Eastern Europe and the Middle East, alongside China’s economic slowdown, present challenges that contribute to market uncertainty.

Conclusion

The S&P 500 remains an essential tool for gauging the state of the U.S. economy. Analysts suggest that as we progress towards the end of the year, market participants should pay close attention to economic data releases and central bank actions, as these will influence sentiment and performance. Forecasts indicate a cautiously optimistic outlook for the index, provided that inflation data stabilizes and corporate earnings remain strong. Investors should continue to diversify their portfolios and stay informed about market developments to navigate these uncertain times effectively.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.