Understanding the Recent Superannuation Tax Changes in Australia

Introduction

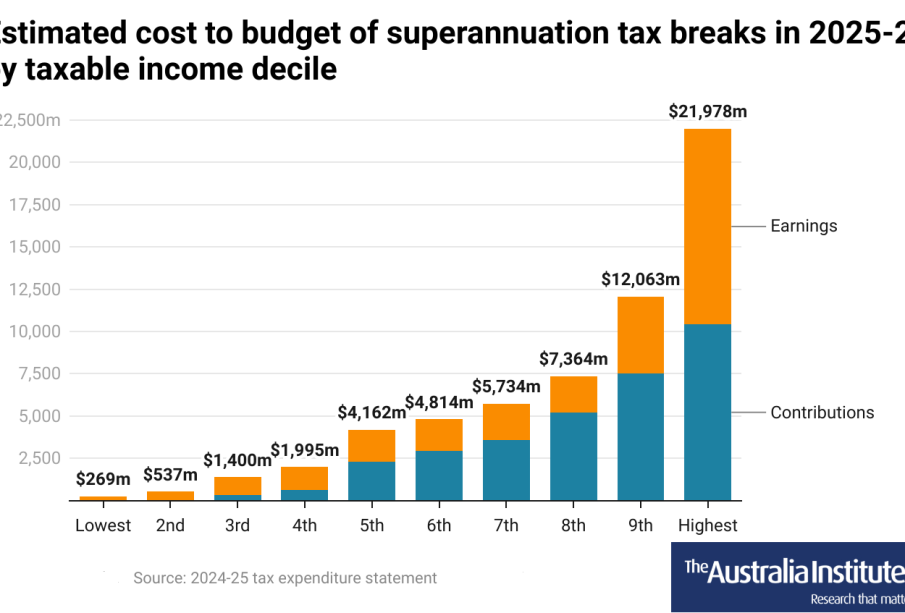

The Australian government recently announced significant changes to the taxation of superannuation, igniting discussions about retirement savings and financial planning. Superannuation is a vital part of the Australian retirement system, ensuring citizens can maintain their living standards post-employment. The proposed tax changes aim to address growing concerns around wealth inequality and the sustainability of the superannuation system.

Details of the Changes

Effective from the beginning of the next financial year, the tax rate on earnings for superannuation balances above $3 million will increase from 15% to 30%. This shift is designed to target high-balance accounts, generating an estimated additional revenue of $2 billion annually for the government. These funds can then be reinvested into public services such as healthcare and education.

The government has justified this move by highlighting that only around 0.5% of superannuation accounts are affected by this change, implying that the majority of Australians will experience no additional tax burden. However, industry experts argue that this could lead to unintended consequences, such as discouraging high-income earners from maintaining their superannuation contributions.

Impacts on Retirement Planning

Financial advisors warn that the increased tax rate may prompt individuals to rethink their retirement strategies. High-income earners might reconsider their investment in superannuation in light of the new tax rates, potentially resulting in a shift toward alternative investment avenues with lower tax implications. Moreover, there are concerns that these changes could further exacerbate existing disparities in retirement savings among Australians.

Conclusion

In conclusion, while the superannuation tax changes are being positioned as reforms aimed at greater equity, they carry ramifications that could overhauls the retirement landscape for many Australians. As the government implements these adjustments, stakeholders are keenly observing the impacts on both high earners and the broader economy. The full extent of these reforms on retirement planning will only be clear over time, making it essential for individuals to seek professional financial advice as they navigate these changes.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.