Understanding the Dow Jones Stock Markets

Introduction

The Dow Jones Stock Markets, often referred to simply as the Dow, are a key barometer for the overall health of the U.S. economy. As one of the oldest and most widely followed stock indices globally, understanding its movements provides investors, analysts, and economic enthusiasts with crucial insights into market trends and investor sentiment. Recent fluctuations, particularly in the context of political developments, macroeconomic factors, and global events, underline the importance of following the Dow Jones closely.

Recent Trends in the Dow Jones

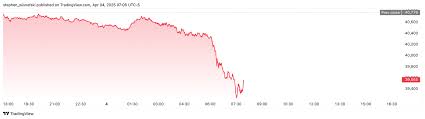

As of late October 2023, the Dow Jones Industrial Average has shown noteworthy volatility influenced by various factors including inflation rates, Federal Reserve policies, and international market conditions. Following a steady rise in earlier months, the index experienced a downturn in recent weeks, largely attributed to disappointing corporate earnings reports and uncertainties surrounding upcoming policy changes. On October 25, 2023, the Dow closed at approximately 32,000 points, down from a peak of over 34,000 points earlier in the month.

Analysts are observing trends that indicate a shift in investor confidence, with many turning towards more defensive stocks amid fears of rising interest rates and a potential economic slowdown. The impact of geopolitical tensions, particularly involving trade relations and conflicts, further complicates the outlook for the Dow Jones and the broader stock market.

The Economic Impact of the Dow

The performance of the Dow Jones is not only significant for investors but also serves as a leading indicator for the U.S. economy. When the index rises, it typically reflects growing corporate profits and consumer spending, while a decline can point to economic downturns. Economists emphasize that sustained periods of decline in the Dow may lead to lower consumer confidence, which can further stagnate economic growth.

Future Outlook

Looking forward, experts predict that the Dow Jones will continue to face challenges, but there are opportunities for growth as global supply chains stabilize and inflation pressures begin to ease. Analysts recommend that investors remain cautious, focusing on diversified portfolios and sectors that display resilience amidst economic changes. The upcoming quarterly earnings season will be crucial, as it may provide further clarity on corporate health and investor sentiment moving into 2024.

Conclusion

In conclusion, the Dow Jones Stock Markets remain an essential component of the financial ecosystem. By keeping an eye on market fluctuations and understanding the underlying factors at play, investors can better navigate the complexities of economic growth and decline. As we head into the final months of 2023, vigilance and strategic planning will be vital for those engaged in stock market activities.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.