Understanding the Dow Jones Industrial Average: Trends and Implications

Introduction to the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is one of the most significant stock market indices globally, representing 30 of the largest publicly traded companies in the United States. Established in 1896, the DJIA serves as a barometer for the overall health and performance of the U.S. economy. Its relevance in today’s rapidly changing economic landscape cannot be overstated, as it impacts investment strategies and market sentiment.

Recent Trends in the Dow Jones

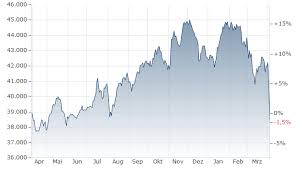

As of early October 2023, the Dow Jones has exhibited notable fluctuations amid ongoing global economic uncertainties. The index recently rose above the 34,000 mark, reflecting investors’ cautious optimism about the ongoing recovery post-COVID-19 pandemic. According to experts, key factors influencing this upward trend include improved corporate earnings reports, strong consumer spending, and a resilient job market.

However, concerns linger regarding inflation rates and the potential ripple effects of geopolitical tensions, particularly in regions like Eastern Europe and the Asia-Pacific. The U.S. Federal Reserve’s monetary policy decisions, especially regarding interest rates, continue to play a pivotal role in shaping market expectations. On October 5, the Fed announced that it would maintain interest rates at their current levels, aiming to strike a balance between growth and controlling inflation.

Implications for Investors

For both seasoned and new investors, understanding the movements of the Dow Jones is crucial. Recent data suggest that technology and healthcare sectors are leading the charge, making them attractive for investment. Investors are advised to consider diversifying their portfolios to include stocks from these sectors while being wary of overexposure to volatile industries.

Many analysts predict that the Dow will experience continued volatility in the coming months, with potential impacts from the upcoming midterm elections and economic data releases. Staying informed and maintaining a long-term perspective will be essential for navigating this uncertain environment.

Conclusion

The Dow Jones Industrial Average remains a key indicator of economic progress and investor sentiment. As markets adapt to evolving internal and external factors, stakeholders must remain vigilant. With the potential for growth tempered by risks, a prudent approach to investment is warranted. By keeping an eye on pivotal trends and understanding the forces at play, investors can make informed decisions that align with their financial goals.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.