Understanding the Current Trends in Tesla Share Price

The Importance of Tesla Share Price

The share price of Tesla, Inc., a leading electric vehicle manufacturer, is not only a reflection of the company’s financial health but also indicates investors’ confidence in the future of the electric automotive industry. As Tesla continues to push boundaries in technology and sustainability, its stock price becomes a topic of significant interest among investors, analysts, and market watchers.

Recent Trends in Tesla Share Price

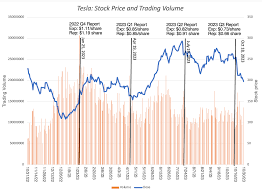

As of late 2023, Tesla’s share price has seen considerable fluctuation. After starting the year strong, the stock had a notable dip in September, falling to approximately AUD 200 per share. This volatility can be attributed to a combination of factors, including broader market conditions, competition in the EV market, and Tesla’s own earnings reports.

Following the Q3 earnings report released on October 18, where Tesla announced an increase in production and delivery numbers, the share price saw a slight recovery, rising to AUD 220. Analysts noted that despite lower-than-expected profit margins, the company’s growth metrics remained promising, contributing to positive investor sentiment.

Factors Influencing Tesla’s Share Price

Several factors drive the performance of Tesla’s share price. The global push for electric vehicles and stringent emission regulations have generally worked in Tesla’s favour. Additionally, the company’s partnerships, new model releases, and advancements in battery technology directly impact investor expectations and stock performance.

However, increasing competition from legacy automotive manufacturers and new entrants in the EV space has put pressure on Tesla’s market share. The emergence of companies like Rivian, Lucid Motors, and traditional giants like Ford and Volkswagen expanding their EV offerings has raised concerns regarding Tesla’s ability to maintain its market dominance.

Future Outlook for Tesla Share Price

Looking ahead, market analysts remain cautiously optimistic about Tesla’s stock. Predictions suggest the share price could stabilize between AUD 210 and AUD 250 over the next six months, contingent upon the company’s ability to address production challenges and maintain its growth trajectory. Additionally, the upcoming launch of Tesla’s new models and expansion into new markets such as India may bolster investor confidence.

Conclusion

The Tesla share price is likely to remain a focal point for investors as the automotive industry evolves. Given Tesla’s pivotal role in pushing electric vehicle adoption worldwide, its stock performance will be indicative not only of the company’s success but also of the broader shift towards sustainable transportation. Investors should stay informed of market trends and company developments as they evaluate Tesla’s future in the ever-changing automotive landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.