Understanding the Current Trends in Tesla Share Price

Introduction to Tesla Share Price

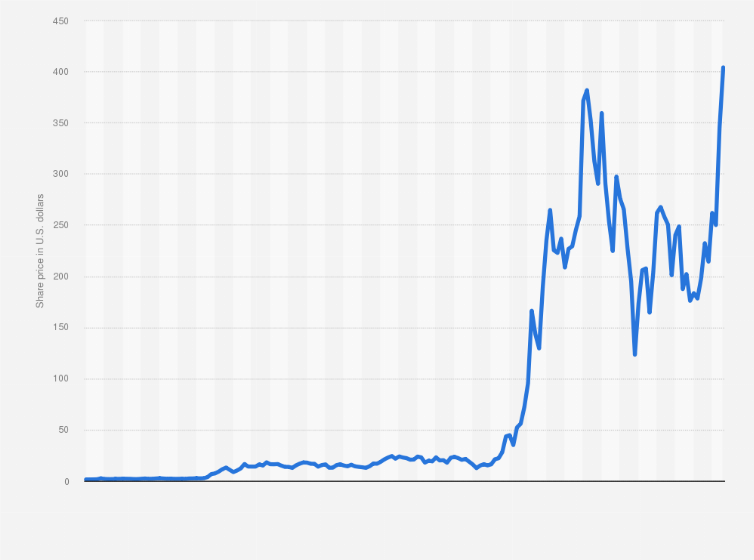

The Tesla share price has garnered significant attention from investors, analysts, and enthusiasts alike. As one of the leading companies in the electric vehicle (EV) market, Tesla’s stock performance often reflects broader trends in the automotive and technology sectors. The fluctuations in its share price can impact not only investor portfolios but also the overall perception of the EV industry’s growth potential.

Recent Developments Influencing Tesla’s Share Price

As of late 2023, Tesla’s share price has faced volatility, influenced by several key factors. The recent announcement of their quarterly earnings results showed a substantial growth in deliveries, exceeding market expectations. This has provided a positive outlook for the company, despite ongoing concerns about competition in the EV market.

Additionally, the impact of external factors cannot be overlooked. Notable fluctuations in raw material costs for battery production, regulatory changes related to EV incentives, and shifts in consumer demand due to economic conditions have collectively played a role in shaping the company’s stock performance. Following its latest earnings call, Tesla’s share price saw a temporary rise of approximately 5%, showcasing investor optimism driven by robust sales data and strategic expansions into new markets.

Analyzing the Performance Metrics

In tandem with these developments, analysts have been assessing Tesla’s forward price-to-earnings (P/E) ratio and its market capitalization. As of October 2023, Tesla’s P/E ratio stands at around 45, which some investors consider high relative to traditional automotive companies. However, many argue that this reflects the anticipated growth in the electric vehicle sector.

Market analysts suggest that Tesla’s ability to innovate and maintain its competitive edge with advancements in battery technology and autonomous driving capabilities will be pivotal. Analyst predictions indicate potential for continued share price growth, particularly if Tesla successfully introduces new models and expands its manufacturing capacity.

Conclusion: What Lies Ahead for Tesla Share Price?

In conclusion, the trajectory of Tesla’s share price will likely remain subject to both internal strategies and external market dynamics. As the general market adjusts to economic shifts, potential investors should keep abreast of Tesla’s operational updates and industry trends. With analysts cautiously optimistic about Tesla’s future performance, now may be a pivotal time for both current and prospective shareholders to evaluate their positions in light of the company’s evolving landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.