Understanding the Current Trends in Oil Prices

The Importance of Oil Prices in Today’s Economy

Oil prices play a crucial role in the global economy, influencing everything from transportation costs to inflation rates. Recently, the oil market has experienced significant volatility, which is pertinent for both consumers and businesses worldwide. Understanding these fluctuations is essential for making informed decisions regarding energy consumption, investment opportunities, and economic forecasting.

Recent Developments in Oil Prices

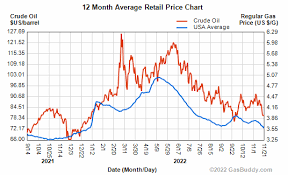

As of October 2023, oil prices have seen notable increases, driven by a combination of geopolitical tensions and supply chain disruptions. According to the latest data from the Energy Information Administration (EIA), the average price of Brent crude oil, a global benchmark, was approximately AUD 115 per barrel. This notable rise is attributed primarily to ongoing tensions in the Middle East, particularly with the conflict involving key oil-producing nations.

In addition to geopolitical issues, the Organization of the Petroleum Exporting Countries (OPEC) has been active in managing oil supply to stabilize prices. Recently, OPEC has agreed to extend production cuts, further tightening global supply. Analysts suggest that these measures have contributed to the upward pressure on prices, making it crucial for nations relying heavily on oil imports to adapt their economic strategies.

Impact on Global Economies

The rise in oil prices has widespread implications. Countries heavily dependent on oil exports, such as Australia, are experiencing increased revenues, which can lead to investments in infrastructure and social programs. Conversely, oil-importing nations are facing rising costs, leading to higher consumer prices. A recent report by the International Monetary Fund (IMF) indicates that higher oil prices could contribute to inflationary pressures, potentially slowing economic growth in affected regions.

Looking Ahead: Predictions and Forecasts

Market experts forecast that the volatility in oil prices is likely to continue into 2024, driven by ongoing geopolitical uncertainties and the transition towards renewable energy sources. While some predict that prices may stabilize, others highlight the potential for further increases as global demand rebounds post-pandemic. This underscores the need for consumers and businesses to remain vigilant regarding energy prices and to consider alternative energy solutions to mitigate risks associated with oil dependency.

Conclusion

The fluctuations in oil prices are of paramount importance in shaping economic landscapes around the world. As geopolitical conditions evolve and the shift toward sustainable energy gains momentum, understanding these trends is essential for informed decision-making. It is clear that both individuals and corporations must prepare for a future where oil prices may remain unpredictable, emphasizing the importance of energy diversification and strategic planning.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.