Understanding the Current Gold Price in Australia

The Importance of Gold Pricing in Australia

The price of gold is a critical economic indicator that influences various sectors from investment to retail. As a country rich in natural resources, Australia stands as one of the largest gold producers globally, making gold pricing a significant issue for both national and international investors.

Current Trends and Influencing Factors

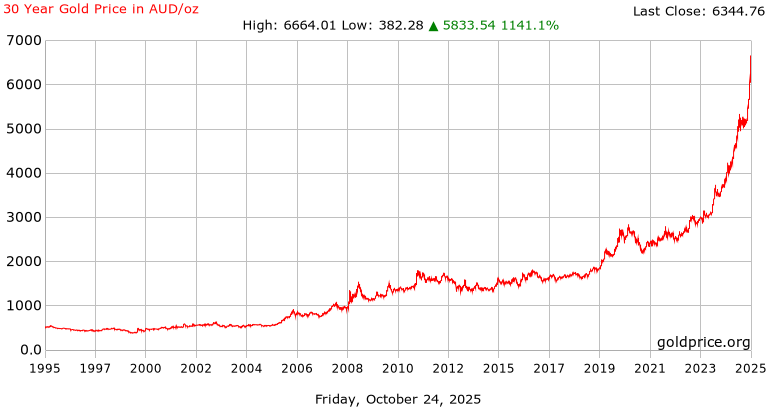

As of October 2023, the gold price in Australia has experienced fluctuations influenced by several factors such as global economic conditions, currency values, and geopolitical uncertainties. Currently, gold is priced at around AUD $2,800 per ounce, marking a modest increase from earlier in the year. The price is expected to maintain volatility due to ongoing inflation concerns and changing interest rates.

The Australian dollar’s strength against other currencies also plays a crucial role in determining gold prices domestically. A stronger AUD typically means a lower gold price in local terms, leading to complex implications for Australian exporters and miners.

Investor Sentiment and Market Implications

Investor sentiment in the Australian gold market appears cautiously optimistic. Many investors see gold as a safe-haven asset amid rising inflation and potential recessions. Experts suggest that factors such as central bank policies, the health of the global economy, and market confidence will significantly influence gold prices in the coming months.

Moreover, the upcoming Federal Reserve meetings in the United States are set to impact international gold prices, which have a direct correlation with the Australian market. As decisions are made concerning interest rates and economic policies, Australian investors closely monitor the outcomes.

Conclusion and Forecast

In conclusion, understanding the gold price dynamics in Australia is essential for investors and stakeholders in the mining sector. As gold prices remain high, it may offer lucrative opportunities for investment, but vigilance is necessary given the unpredictable nature of the market. Experts encourage potential investors to stay informed about economic indicators and market forecasts to navigate the ongoing changes effectively.

The coming months could see more volatility in gold prices, influenced heavily by international events and domestic economic performance. Remaining proactive and informed can help investors make strategic decisions in the ever-evolving landscape of gold investment in Australia.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.