Understanding the Current Gold Price in Australia

Introduction

The gold price in Australia is a topic of great interest for investors, traders, and the general public alike. Gold has traditionally been viewed as a safe-haven asset, especially during times of economic uncertainty. Recent fluctuations in global markets have brought attention to the factors influencing gold prices, making it crucial for Australians to stay informed about these trends and their implications.

Current Trends in Gold Prices

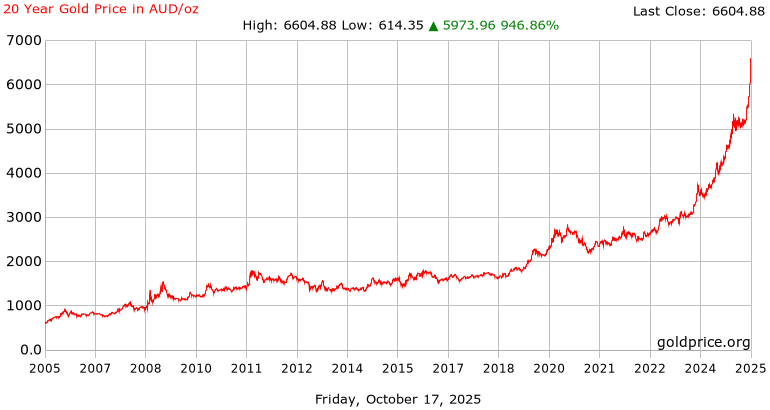

As of mid-October 2023, the price of gold in Australia has seen significant fluctuations, currently trading around AUD 2,800 per ounce, having risen approximately 15% over the past six months. This increase can be attributed to several factors, including global economic instability, geopolitical tensions, and inflationary pressures affecting various markets. The Reserve Bank of Australia’s decisions on interest rates also contribute to the movement of gold prices, as lower interest rates generally encourage investment in gold over interest-bearing assets.

Factors Influencing Gold Prices

Several key factors are influencing gold prices in Australia:

- Inflation: With rising inflation rates worldwide, investors tend to flock to gold as a hedge against the diminishing purchasing power of currency.

- US Dollar Strength: Since gold is priced in USD, any fluctuations in the value of the US dollar can impact gold prices. A weaker US dollar generally leads to higher gold prices.

- Geopolitical Issues: Ongoing global conflicts and uncertainties prompt investors to seek refuge in gold, thereby increasing its demand and price.

- Central Bank Policies: Decisions made by the Reserve Bank of Australia (RBA) regarding interest rates also affect the gold market. Recent indications of maintaining lower rates to stimulate growth have further buoyed gold prices.

Future Predictions

Market analysts predict that the gold price in Australia may continue to rise in the near term, driven by ongoing economic uncertainty and fluctuating inflation rates. However, as with any investment, there is inherent risk, and potential investors should consider their strategies carefully.

Conclusion

The current gold price in Australia is not just a number; it represents broader economic trends and investor sentiment. For anyone interested in gold as an investment or simply understanding the market, keeping abreast of these developments is essential. As Australia navigates these economic challenges, the gold market will likely remain a barometer of financial health and security.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.