Understanding the Centrelink Age Pension: Eligibility and Benefits

Introduction to the Centrelink Age Pension

The Centrelink Age Pension is a crucial financial support system available to older Australians who meet specific eligibility requirements. As Australia’s population ages, understanding this form of income assistance becomes increasingly important. It ensures that seniors can maintain a reasonable standard of living in their retirement years, helping to alleviate poverty among the elderly. With recent demographic shifts and economic challenges, the Age Pension remains a vital topic in Australian social policy.

Eligibility Criteria

To qualify for the Centrelink Age Pension, individuals must meet age, residency, and income tests. Currently, the qualifying age for both men and women is set to rise to 67 years by July 2023. Aside from being of age, applicants must be an Australian resident and have lived in the country for a minimum of ten years, with certain exceptions. The income test is complex, taking into account various sources of income, including other pensions, salaries, and investment earnings. A couple’s combined income must also not exceed set thresholds.

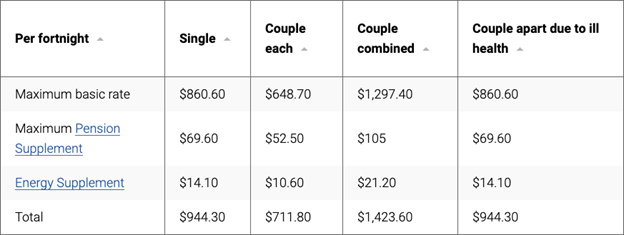

Financial Benefits

The Age Pension provides a base payment that is means-tested, meaning that the amount received depends on an individual’s financial situation. As of September 2023, the maximum payment rates are approximately $1,000 per fortnight for singles and about $1,500 for couples. However, these amounts can decrease if the recipient has additional income or assets, emphasizing the need for accurate reporting when applying. Supplementary benefits may be available, such as the Pensioner Concession Card, which offers discounts on health care, public transport, and other necessities.

Application Process

Applying for the Age Pension involves submitting a claim to Services Australia, which manages Centrelink. Applicants can apply online, via mail, or in person at their local Centrelink office. It is advisable for individuals to prepare their documentation in advance, including proof of identity, details regarding their financial situation, and any other relevant information. The processing time can vary, but applicants are encouraged to start the process at least a few months before they turn the qualifying age.

Conclusion and Future Outlook

Given the increasing demands on Australia’s welfare system and an aging population, the Centrelink Age Pension will continue to play a critical role in supporting seniors. As economic conditions change and more Australians reach retirement age, ongoing discussions around pension reforms, including the adequacy and structure of the Age Pension, will be essential in ensuring that it meets the needs of the population. Therefore, understanding the Age Pension eligibility and benefits is crucial for current and future retirees to navigate their financial futures effectively.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.