Understanding the Australian Federal Budget Tax Cuts 2023

Introduction

The announcement of tax cuts within the Australian Federal Budget is always a significant event, affecting both the economic landscape and the daily lives of citizens. These tax cuts are critical in shaping government policy, influencing consumer spending, and addressing cost of living pressures. As the Australian economy strives for stability and growth in the wake of global uncertainties, understanding the implications of these tax cuts is more relevant than ever.

Key Details of the Tax Cuts

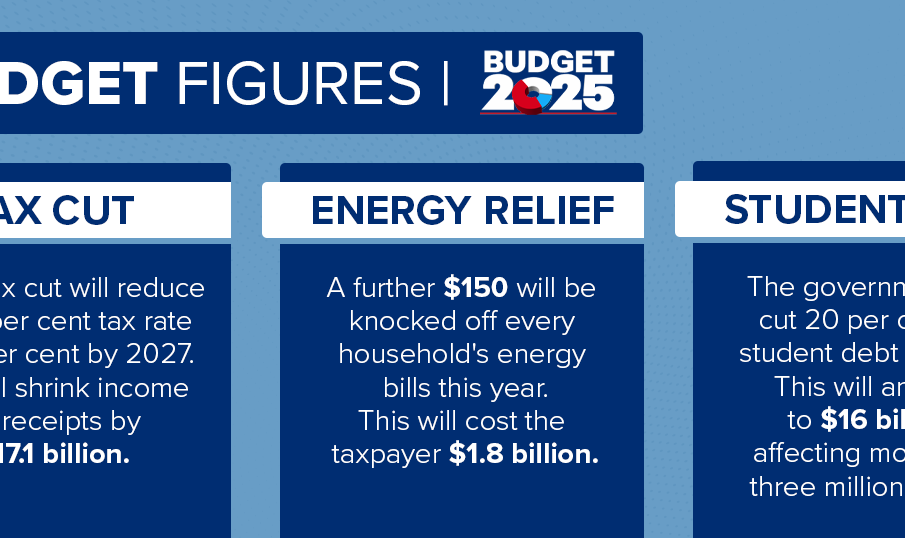

In the 2023 Federal Budget, Treasurer Jim Chalmers unveiled a series of tax relief measures aimed at easing the financial burden on Australian households and businesses. The tax cuts are designed to enhance disposable income, thereby stimulating consumer spending and investment in local economies.

Specifically, the budget proposed an increase in the tax-free threshold for low-income earners and a reduction in the tax rates for middle-income earners. These changes are expected to particularly benefit those earning between $45,000 and $180,000, who will see substantial reductions in their tax liabilities. Furthermore, small businesses will be granted additional deductions to encourage investment in growth and innovation.

Economic Context

The backdrop to these tax cuts includes rising inflation and the need for economic recovery post-COVID-19. The government positioned these cuts as a means to boost consumer confidence and stimulate economic activities that were dampened during the pandemic. Additionally, ensuring that working Australians retain more of their earnings is seen as essential in supporting families facing increased costs, particularly in housing and essential goods.

Predicting the Impact

While the intent behind the tax cuts is clear, analysts have varied views on their long-term impact. Proponents argue that the cuts could lead to increased consumer spending and support for local businesses, thereby driving growth. However, critics express concern about potential impacts on government revenue and the capacity to fund essential services in the future.

Moreover, as inflation concerns persist, it remains uncertain whether the benefits of these tax cuts will be completely absorbed by rising prices or whether they will successfully uplift the standard of living for many Australians.

Conclusion

The Australian Federal Budget tax cuts of 2023 mark a pivotal moment in the government’s approach to economic recovery and support for its citizens. As the implementation unfolds, it will be crucial for both policymakers and citizens to monitor the effects on the economy and family budgets alike. The significance of these tax cuts lies not only in the immediate fiscal relief but also in their potential to shape Australia’s economic environment in the years to come.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.