Understanding the ASX All Ordinaries Index in 2023

Introduction to the ASX All Ordinaries

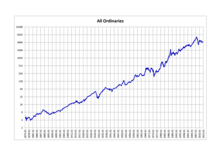

The ASX All Ordinaries, often referred to as the All Ords, is a critical benchmark for the Australian stock market. It encapsulates the performance of the 500 largest companies listed on the Australian Securities Exchange (ASX), making it an important indicator for investors and analysts alike. Understanding its movements, trends, and factors influencing its fluctuations is essential for anyone engaged in the Australian financial landscape.

Recent Performance of the All Ords

As of October 2023, the ASX All Ordinaries has shown resilience amidst global market fluctuations caused by interest rate changes and geopolitical tensions. The index opened the month at approximately 7,150 points, reflecting a slight increase compared to previous weeks. Notably, sectors such as financials and materials have been driving the index, buoyed by strong earnings reports and positive commodity prices.

One prevailing factor impacting the All Ords is the performance of major players like BHP and Commonwealth Bank. BHP, a significant contributor to the materials sector, saw its shares rise by 3.5% recently, thanks to increased demand for iron ore. Conversely, Commonwealth Bank’s shares have faced pressure due to investor concerns over potential interest rate increases, contributing to a moderate decline in financial sector performance.

Factors Influencing the ASX All Ordinaries

Several key factors influence the ASX All Ords:

- Interest Rates: Changes in the Reserve Bank of Australia’s monetary policy directly affect the market.

- Commodity Prices: As Australia is a significant exporter of natural resources, fluctuations in commodity prices greatly influence the index.

- Global Economic Conditions: Events such as the ongoing tensions in Eastern Europe and trade policies impact investor sentiment.

Future Outlook

Looking ahead into the remainder of 2023, analysts predict that the ASX All Ordinaries is likely to remain volatile, heavily influenced by global economic trends and domestic policy changes. Some analysts suggest cautious optimism, foreseeing potential gains if major economic indicators point towards stabilization. Nevertheless, volatility stemming from international markets cannot be disregarded.

Conclusion

The ASX All Ordinaries Index remains a crucial touchpoint for understanding the Australian equities landscape. For investors, keeping an eye on the index’s performance and the influencing factors is essential. While 2023 has presented challenges, it also offers opportunities for strategic investments, underscoring the importance of ongoing market education and informed decision-making.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.