Understanding the ASX 200: Trends and Importance

Introduction to the ASX 200

The ASX 200 is Australia’s leading stock market index, representing the top 200 companies listed on the Australian Securities Exchange (ASX) by market capitalisation. Established in 2000, it serves as a barometer for the country’s economic health, reflecting corporate performance and investor sentiment. The trends within the ASX 200 are crucial not only for investors and analysts but also for policymakers and economists as it influences investment decisions and economic strategies.

Recent Trends and Market Performance

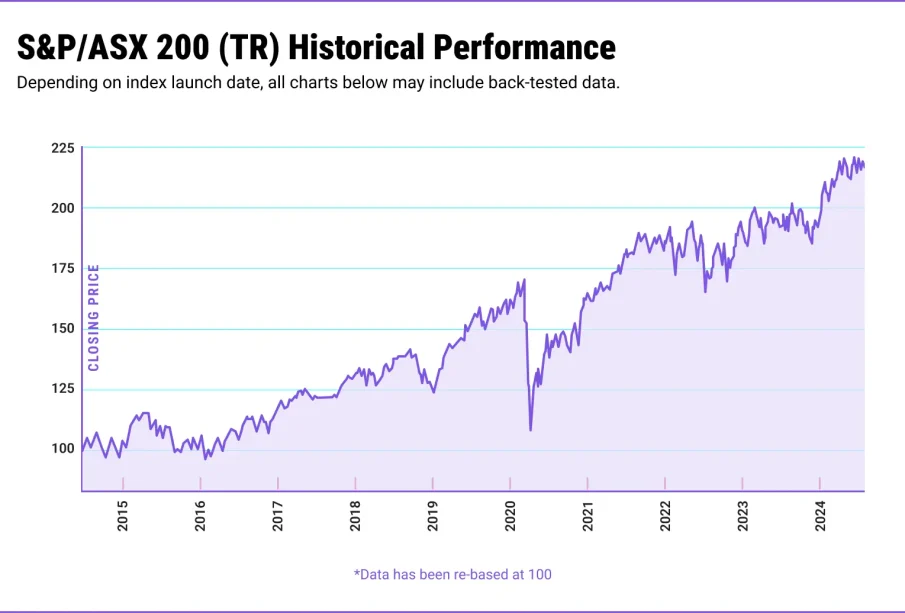

As of October 2023, the ASX 200 has shown varied performance amidst global economic fluctuations. The index has experienced volatility, prompted by ongoing concerns about inflation, interest rate hikes, and geopolitical tensions. Recent data suggests a mild recovery following a dip earlier in the year. The index has rebounded by approximately 5% over the last quarter, buoyed by strong performances in sectors such as healthcare, consumer staples, and financial services.

One of the standout performers has been the technology sector, with companies like Afterpay and Xero reporting robust quarterly gains, driven by increased consumer digitalisation. However, the energy sector has shown weakness attributed to fluctuating oil prices and changing environmental policies.

Influence of Global Events

Global events significantly impact the ASX 200. For instance, the Federal Reserve’s monetary policy decisions in the United States often have a ripple effect on Australian markets. Investors are currently wary as central banks worldwide signal ongoing rate hikes to combat inflation, which can dampen corporate profits and economic growth.

Significance for Investors

The ASX 200 serves as a vital tool for investors, offering insight into market trends and facilitating diversified investment strategies. It also plays a pivotal role for superannuation funds and institutional investors as they allocate resources depending on index performance. The index’s movements can indicate market sentiment; a rising ASX 200 often correlates with economic confidence while downturns may suggest caution among investors.

Your investment decisions should always consider current ASX 200 trends, including shifts in sector performance and economic indicators. Analysts recommend regular monitoring of the index to capitalise on opportunities and mitigate risks.

Conclusion

The ASX 200 remains a key player in understanding Australia’s economic landscape. With ongoing developments influencing the market, it’s imperative for investors and stakeholders to stay informed. As global economic conditions evolve, the future of the ASX 200 will likely reflect broader trends in investor confidence and economic performance. Understanding this index not only aids in making informed investment decisions but also provides insight into potential future shifts within the Australian economy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.