Understanding the ANZ share price: drivers, risks and outlook

Introduction: Why the ANZ share price matters

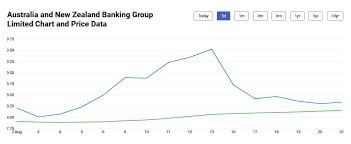

The ANZ share price is closely watched by retail and institutional investors across Australia and beyond. Movements in the stock reflect investor sentiment about the bank’s profitability, the health of the broader economy and expectations for interest rates and credit conditions. For shareholders and prospective buyers, understanding the drivers of the ANZ share price is important for portfolio decisions and income planning.

Main factors influencing the ANZ share price

Monetary policy and interest rates

Changes in the official cash rate influence net interest margins for banks and are therefore a key input for analysts valuing ANZ shares. Expectations around rate rises or cuts tend to be priced into bank shares ahead of formal central bank decisions.

Credit conditions and economic outlook

Trends in lending demand, household debt levels and unemployment affect loan growth and credit quality. Deterioration in credit conditions can lead to higher provisions for bad debts and weigh on the ANZ share price, while a stronger economic backdrop can support earnings and investor confidence.

Earnings, dividends and capital management

Reported profit results, dividend declarations and capital ratios are primary company-specific drivers. Investors typically monitor interim and full-year results for guidance on future returns and capital distribution policies.

Regulation and market sentiment

Regulatory changes, compliance matters and broader market sentiment toward the banking sector also impact the ANZ share price. News about regulatory reviews, litigation or changes to prudential settings can create volatility.

Conclusion: What readers should watch next

For those tracking the ANZ share price, close attention to upcoming earnings releases, central bank communications and economic indicators will be valuable. Short-term movements often reflect sentiment and news flow, while longer-term returns depend on sustained earnings growth, dividend policy and the macroeconomic environment. Investors should align any view on the ANZ share price with their risk tolerance, investment horizon and the latest publicly available company and market information.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.