Understanding Tesla Share Price and Its Market Impact

The Importance of Tesla Share Price

Tesla’s share price is a critical indicator not only for investors but also for the broader automotive and technology sectors. As a leading player in the electric vehicle (EV) market, the performance of Tesla’s stock can significantly impact investor sentiment and market trends. Recent fluctuations in Tesla’s share price have raised questions regarding the company’s future growth prospects, production capabilities, and competitive landscape.

Recent Trends and Market Performance

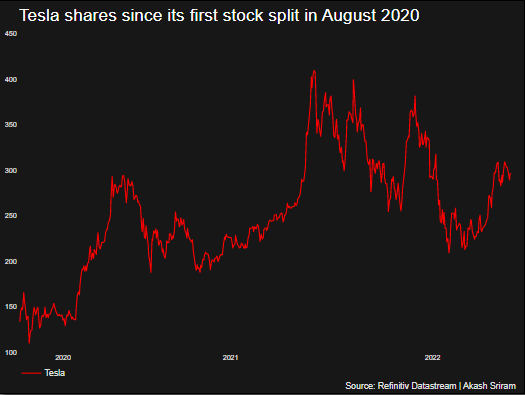

As of late October 2023, Tesla’s share price has been in the spotlight, currently trading around AUD 260 after reaching a peak of AUD 300 earlier this year. This decline has sparked discussions about the factors influencing the stock’s performance. Analysts attribute the recent drop to several factors including supply chain issues, competition from traditional automotive manufacturers entering the EV market, and concerns about production targets.

Additionally, Tesla’s decision to reduce the prices of its vehicles in various markets has raised eyebrows. While aimed at boosting demand, it has raised concerns about profit margins, which directly affect share price. In contrast, the company recently reported robust delivery numbers for Q3 2023, which surprised some analysts and provided a temporary boost to the stock.

Market Influences and Investor Sentiment

The EV sector is currently experiencing rapid growth, but it’s also becoming increasingly saturated. Companies like Ford, GM, and newer entrants such as Rivian are ramping up production, which is putting pressure on Tesla to maintain its market share. Furthermore, rising interest rates and potential economic downturns are influencing investor sentiment, leading to volatility in share prices across tech stocks including Tesla.

Looking Ahead

Experts believe that Tesla’s ability to innovate, ramp up production, and deliver on its promises will be crucial in the upcoming quarters. The company’s emphasis on developing new models and expanding its manufacturing facilities could play a pivotal role in stabilizing and potentially increasing its share price moving forward.

In conclusion, Tesla’s share price is closely monitored and influenced by a multitude of market factors. For investors and stakeholders, understanding these dynamics is essential for making informed decisions. The coming months will be critical for Tesla as it navigates the challenges within the EV market while working to develop new technologies that could give it an edge over competitors.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.