Understanding RBA Interest Rates and Their Impact

Introduction

The Reserve Bank of Australia (RBA) plays a crucial role in shaping the nation’s economy, primarily through its monetary policy decisions. One of the most significant tools at its disposal is setting the official cash rate, commonly known as the RBA interest rate. These rates directly influence borrowing costs, consumer spending, and overall economic growth, making it an essential topic for both consumers and businesses alike.

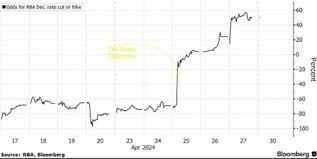

Current State of RBA Interest Rates

As of October 2023, the RBA has maintained its interest rate at **4.10%**, a level that has remained unchanged since August after a series of increases earlier in the year. The bank’s decision-making has been largely influenced by inflation concerns, which, according to recent data, has shown signs of stabilising but remains above the RBA’s target range of 2-3%.

Economic Indicators and Considerations

Recent economic indicators suggest a mixed outlook. While the unemployment rate has remained relatively low at **3.6%**, wages have seen minimal growth, leading to concerns about consumer purchasing power. Additionally, the housing market has started to show signs of strain, with some analysts predicting potential declines in property prices if interest rates remain elevated for an extended period.

Moreover, the RBA’s decision to hold rates steady has stirred debate among economists. Some argue that further rate hikes are necessary to combat inflation and ensure long-term economic stability, while others warn that excessive increases could tip the economy into recession.

Global Influences

The RBA’s interest rate decisions are also influenced by international economic conditions. With many central banks globally, including the Federal Reserve in the United States, raising rates to combat inflation, the RBA must carefully consider the risks of both global inflationary pressures and the potential for a slowdown in external demand for Australian exports.

Conclusion

The current RBA interest rate of 4.10% reflects careful consideration of both domestic and international economic conditions, as well as the need to control inflation without jeopardising growth. As consumers, investors, and businesses navigate this complex landscape, understanding the implications of interest rate changes is vital. In light of the mixed economic indicators, the RBA’s decisions in the near future will be crucial for Australia’s financial health. Analysts predict that any changes will be closely monitored, and stakeholders should prepare for potential fluctuations as the RBA responds to evolving economic conditions.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.