Understanding RBA Interest Rate Cuts: Current Trends and Insights

Introduction

The Reserve Bank of Australia (RBA) plays a critical role in shaping the country’s economic landscape, particularly through its monetary policy and the adjustment of interest rates. As the RBA seeks to stimulate growth and tackle inflation, the recent interest rate cuts have become a topic of significant interest among economists, investors, and the general populace. Understanding the implications of these cuts is crucial for consumers, as it impacts borrowing costs, savings returns, and overall economic activity.

Current Context of RBA Rate Cuts

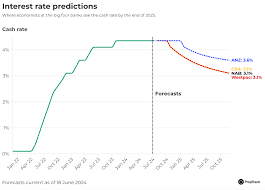

In 2023, the RBA has implemented a series of interest rate cuts aimed at supporting the economy post-pandemic and countering the effects of global financial pressures. After a period of aggressive rate hikes, designed to combat rising inflation, the RBA shifted its focus in June 2023, announcing a reduction in the cash rate from 4.1% to 3.85%. This decision came at a time when economic indicators suggested a slowdown in consumer spending and a rise in unemployment.

The RBA’s policy adjustments are often in response to key economic indicators. In recent meetings, the RBA noted that inflationary pressures had started to alleviate, offering a conducive environment for rate cuts. With inflation expected to drop, the central bank aims to support borrowing and consumer confidence while promoting sustainable economic recovery.

Implications for Consumers and Businesses

The implications of the RBA’s interest rate cuts are far-reaching. For consumers, lower interest rates typically translate to reduced mortgage repayments and cheaper loans. This has the potential to increase disposable income, encouraging spending and investment in sectors like housing and retail.

Small businesses, which often rely on loans for growth and operations, could also benefit significantly from these cuts. With lower borrowing costs, many businesses may consider expanding their operations, hiring more staff, or investing in new technologies.

Conclusion

The RBA’s interest rate cuts hold notable significance for the Australian economy as it navigates the post-COVID landscape. While the immediate effects include lower loan costs and enhanced consumer spending power, the long-term impacts will depend on the sustainability of economic growth and inflation levels. Analysts suggest that future rate adjustments will depend heavily on economic trends, not only in Australia but also globally. As such, consumers and businesses should remain vigilant, adapting their financial strategies in line with the RBA’s monetary policy changes to ensure financial wellbeing amid an evolving economic environment.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.