Understanding NAB Share Price Trends and Their Implications

Introduction to NAB Share Price

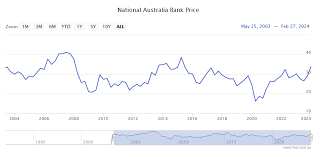

The share price of the National Australia Bank (NAB) is a pivotal indicator of economic health and investor sentiment. As one of Australia’s major financial institutions, fluctuations in NAB’s share price can provide insights into the broader banking sector, market trends, and overall investor confidence. Recent developments and economic conditions make it crucial for investors and stakeholders to keep abreast of these changes.

Current Trends in NAB Share Price

As of October 2023, NAB’s share price has shown signs of volatility, reflecting both internal performance metrics and external market conditions. The stock price saw an increase of approximately 4% over the past month, closing at AUD 31.50, driven by strong quarterly earnings reports that exceeded analyst expectations. Analysts noted that a 14% rise in net profit after tax to AUD 2.2 billion for the year was a key factor contributing to this upward trend.

Economic Factors Influencing NAB’s Share Price

A myriad of economic factors plays into the fluctuation of NAB’s share price. The RBA’s recent adjustments to interest rates have directly influenced borrowing costs, impacting the bank’s profitability. Another critical aspect is the state of the Australian housing market; a steady rise in house prices can lead to increased demand for mortgage products, thereby enhancing NAB’s earnings potential.

Furthermore, international markets also exert influence over NAB’s performance, particularly given the interconnectedness of global economies. The current economic climate, marked by inflation and ongoing geopolitical tensions, has led to heightened uncertainty among investors, often affecting banking shares across the board.

Looking Ahead: Predictions for NAB Share Price

Looking towards the future, analysts suggest that NAB’s share price could experience further fluctuations as the bank navigates an evolving economic landscape. Key factors such as potential interest rate hikes, changes in regulatory frameworks, and the impact of technological advancements on banking practices will likely play significant roles in shaping NAB’s performance.

For investors considering NAB shares, it is essential to remain informed about both macroeconomic indicators and company-specific developments. While there is potential for growth, the associated risks must be understood and managed to make informed investment decisions.

Conclusion

In conclusion, NAB’s share price serves as an important barometer for understanding the bank’s performance within the financial sector. Continued monitoring of market trends, economic indicators, and NAB’s strategic initiatives will be vital for stakeholders as they chart the future of their investments in this prominent bank. The coming months are expected to provide clearer insights as further financial disclosures and economic updates are released.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.