Understanding NAB Share Price: Recent Trends and Insights

Importance of NAB Share Price Analysis

The NAB (National Australia Bank) share price is a critical indicator of the bank’s financial health and market performance. As one of Australia’s largest financial institutions, fluctuations in its share price can impact not only investors but also the broader economy. Keeping track of NAB’s stock is essential for prospective investors, analysts, and anyone interested in the Australian financial landscape.

Current Trends in NAB Share Price

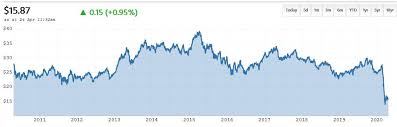

As of October 2023, NAB has experienced some volatility in its share price due to a combination of global economic conditions, interest rate changes, and local market dynamics. As reported, the NAB share price recently hovered around AUD 30 per share, showing a slight increase of approximately 2% from the previous month. This upward movement is attributed to an increase in retail banking margins and strategic shifts towards digital banking solutions, which have been well received by the market.

Factors Influencing NAB’s Share Price

Several key factors have contributed to the recent changes in NAB’s share price:

- Economic Indicators: The Australian economy has been showing signs of resilience with steady employment rates and consumer spending, which positively affects the financial sector.

- Interest Rate Decisions: The Reserve Bank of Australia’s monetary policy, including any hikes or cuts in interest rates, plays a critical role in shaping bank profitability and ultimately the share prices of institutions like NAB.

- Competitive Landscape: NAB’s performance relative to its competitors, such as Commonwealth Bank and Westpac, also influences investor sentiment and market share movements.

Future Outlook for NAB Share Price

Looking ahead, market analysts expect NAB’s share price to continue to be influenced by both domestic and global economic factors. The ongoing shifts toward digital banking and changing consumer preferences, especially after the pandemic, may provide growth opportunities. Additionally, any changes in government policies impacting the banking sector will be closely monitored. Investors are advised to keep an eye on NAB’s quarterly earnings reports and relevant economic indicators as these will provide insights into the bank’s future performance.

Conclusion

In summary, the NAB share price remains an essential metric for evaluating the bank’s financial standing and prospective growth. With the current trends indicating cautious optimism, staying informed on both economic developments and NAB’s strategic initiatives will be vital for investors considering involvement in this key player in the Australian banking sector.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.