Understanding NAB Share Price Movements and Market Impact

Introduction

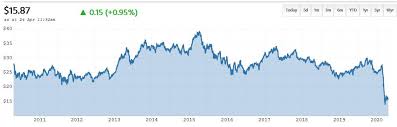

The NAB (National Australia Bank) share price is a crucial indicator of the bank’s financial health and investor sentiment in Australia’s banking sector. As a major player in the financial landscape, fluctuations in NAB’s share price can offer insights into economic stability, investor confidence, and broader market trends. Understanding these movements is important for investors and stakeholders alike as they navigate their financial strategies.

Current State of NAB Share Price

As of October 2023, NAB’s share price has shown notable volatility reflecting both domestic economic conditions and global financial events. The latest reports indicate that the NAB share price is trading at $32.50, having experienced a slight decline of approximately 2% over the past week.

This decline can be attributed to several factors, including recent interest rate changes by the Reserve Bank of Australia (RBA) and ongoing concerns regarding inflation impacting the banking sector. Additionally, NAB has faced scrutiny over its loan performance metrics, leading to investor caution.

Market Influences and Investor Sentiment

Several external factors also contribute to the fluctuation in NAB’s share price. The Australian economy is currently grappling with rising inflation rates and uncertain global economic conditions, which in turn affect consumer confidence and spending. Analysts believe that NAB’s partial dependence on the housing market adds another layer of complexity, especially as mortgage rates rise.

Moreover, investor sentiment is heavily influenced by the performance of Australia’s Big Four banks, including ANZ, Westpac, and Commonwealth Bank. Recent earnings reports and dividend announcements from these banks also have implications for NAB, as investors compare performance metrics.

Future Outlook and Predictions

Experts predict that the NAB share price may see fluctuations in the coming months based on economic indicators and market reactions to RBA decisions. With analysts forecasting possible interest rate pauses early next year, there may be a resurgence of confidence among investors, contingent upon improvements in economic performance.

Investors are advised to consider their long-term strategies and remain updated on potential impacts from both domestic and international economic developments. Continuous monitoring of NAB’s financial health and broader market trends will be essential in making informed decisions.

Conclusion

The NAB share price remains a key financial metric for both analysts and casual investors alike, reflecting the current economic climate and potential future trends. As interest rates and inflation fluctuate, NAB’s stock performance highlights the interconnectedness of markets, banking operations, and investor psychology. Keeping an eye on these developments may help investors capitalize on future opportunities while navigating challenges.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.