Understanding Microsoft’s Share Price: Recent Trends and Analysis

Introduction

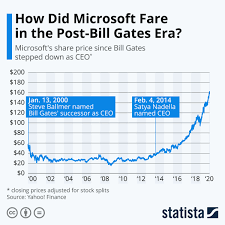

The share price of Microsoft Corporation (MSFT) is a crucial indicator of the company’s performance and a reflection of investor sentiment in the tech industry. As one of the largest companies in the world by market capitalization, fluctuations in Microsoft’s stock not only affect shareholders but also influence the broader technology market and economy. Understanding the drivers behind its share price is essential for investors, analysts, and anyone interested in the stock market.

Recent Developments

As of October 2023, Microsoft’s share price has experienced noteworthy movements influenced by several factors, including quarterly earnings reports, market trends in the tech sector, and macroeconomic conditions. In its recent quarterly earnings report released earlier this month, Microsoft reported a 10% increase in revenue year-over-year, largely driven by growth in its cloud computing division, Azure. This performance sparked a surge in investor confidence, resulting in a notable rise in share price.

Market Trends

Despite the overall positive outlook from Microsoft’s earnings, external factors such as inflation worries and interest rate hikes have contributed to volatility in the technology sector. Tech stocks, including Microsoft, have faced selling pressures as investors reassess risk amidst economic uncertainties. Analysts are closely watching how these factors will play out in the coming months.

Moreover, Microsoft’s strategic acquisitions and investment in artificial intelligence (AI) technologies have also played a role in shaping investor perceptions. The recent announcement of new AI-powered features in Microsoft 365 could further enhance productivity and competitiveness against rivals, which in turn may positively impact its share price.

Conclusion

In summary, Microsoft’s share price remains a topic of interest for investors and market analysts. The company’s strong performance in cloud services, along with advancements in AI, points towards a promising future. However, it is crucial to keep an eye on external economic conditions that may affect the broader tech market. For shareholders and prospective investors, understanding these dynamics will be key in making informed decisions in the ever-evolving landscape of technology stocks.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.