Understanding Home Loan Interest Rates in Australia

The Importance of Home Loan Interest Rates

Home loan interest rates are a crucial aspect for potential homeowners and investors in Australia. These rates directly affect monthly repayments and overall borrowing costs, making it vital for borrowers to stay informed about the current rates and market trends. With recent economic shifts and the Reserve Bank of Australia’s monetary policy, understanding the landscape of home loan interest rates is more important than ever.

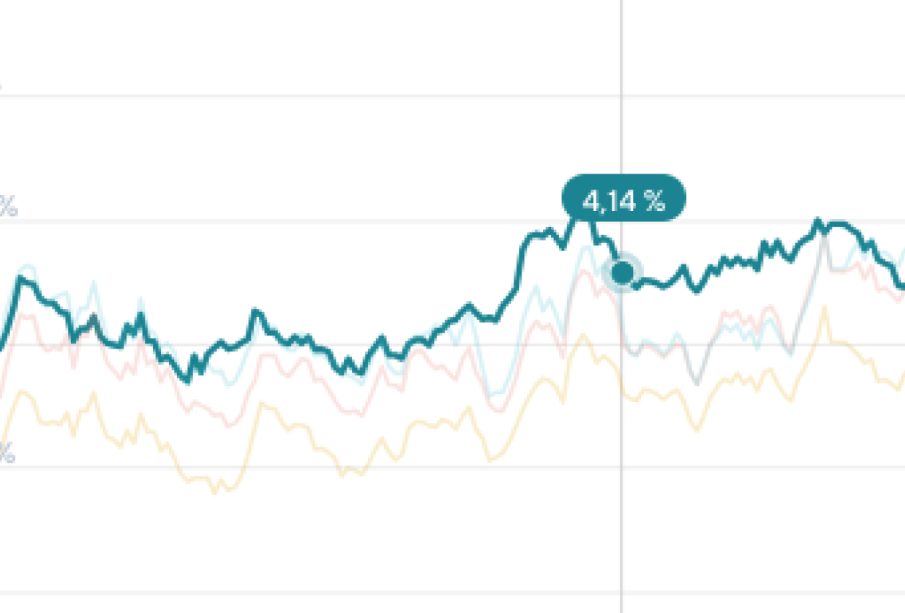

Current Trends in Home Loan Interest Rates

As of late 2023, the Australian housing market has seen fluctuating interest rates, primarily due to the Reserve Bank of Australia’s decisions aimed at curbing inflation. In October 2023, the cash rate remains at 4.10%, influencing lenders to adjust their offerings accordingly. Major banks, including Commonwealth Bank, Westpac, and ANZ, continue to offer competitive rates averaging between 5.5% and 6.20% for variable rate home loans and fixed-rate loans range from 5.8% to 6.5% depending on the loan term.

In recent months, there has been a noticeable shift in borrower sentiment. Many Australians are leaning towards fixed-rate loans to secure low rates amid fears of rising costs in the future, especially as inflation appears persistent across the economy. A survey conducted by Mortgage Choice found that about 60% of homebuyers are opting for fixed-rate loans this year, reflecting a significant increase compared to previous years.

Impact on Borrowers

The current economic climate has heightened concerns for borrowers, particularly first-home buyers who are already facing challenges due to rising property prices and tighter lending conditions. With interest rates climbing, many are finding it increasingly difficult to qualify for loans. Experts suggest that potential homebuyers consider their financial situations carefully, including the ability to handle rate rises, before committing to a mortgage.

Looking Ahead

Forecasts suggest that home loan interest rates may not decrease substantially in the near future. Economic experts predict that the Reserve Bank will maintain higher interest rates until inflation is contained effectively. Homebuyers and investors are advised to keep a close eye on financial news and market movements as they navigate their home loan options.

In conclusion, understanding home loan interest rates is key for anyone engaging in the property market in Australia. Staying informed about current rates and market trends can significantly impact financial decisions and borrowing potential.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.