Understanding Google Share Price: Trends and Market Insights

Introduction

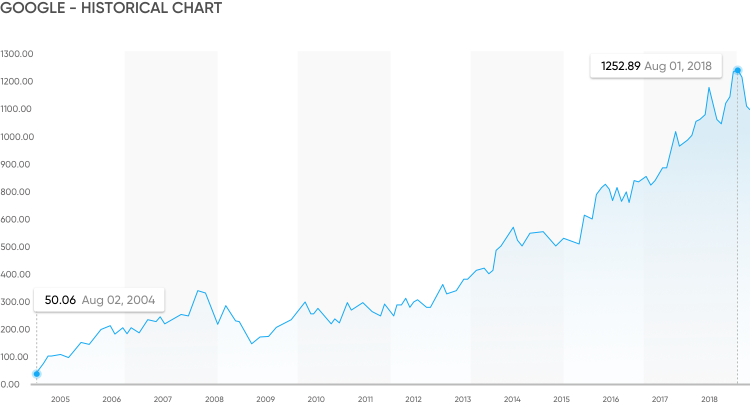

The share price of Google, under its parent company Alphabet Inc., is a crucial indicator of the company’s market health and investor confidence. As one of the largest technology companies globally, fluctuations in Google’s share price can reflect broader economic trends and investor sentiment towards technology stocks. Understanding these dynamics is essential for investors, analysts, and anyone tracking the tech sector.

Recent Performance of Google Share Price

As of early October 2023, Google’s share price has exhibited significant volatility. After reaching an all-time high of approximately AUD 3,000 per share in June, the stock experienced a correction due to broader market pressures, including concerns about inflation and interest rate hikes. In recent trading sessions, Google’s share price has stabilized around AUD 2,800, making it an attractive option for potential investors banking on a recovery.

Factors Influencing Share Price

Several factors influence the performance of Google’s share price. These include:

- Market Sentiment: Economic indicators like inflation rates impact investor confidence. As interest rates rise, technology stocks often face downward pressure as investors become increasingly risk-averse.

- Company Earnings Reports: Alphabet’s quarterly earnings significantly sway its share price. In Q2 2023, the company reported a revenue increase of 8% year-on-year, attributed to robust growth in cloud services and ad sales, positively impacting its stock.

- Regulatory Challenges: Antitrust lawsuits and regulatory scrutiny in both the US and Europe can negatively affect investor sentiment and stock performance.

- Technological Advancements: Innovations and expansions into AI and other technologies also enhance investor attractiveness and can buoy share prices.

Future Projections

Analysts predict that Google’s share price may continue to fluctuate in the short term but could trend upwards as economic conditions stabilize and the company realises further growth in its key sectors. Many analysts maintain a “buy” or “hold” rating, suggesting potential for long-term growth, especially with increasing investments in artificial intelligence and cloud computing.

Conclusion

In summary, Google’s share price serves as an important gauge of both the company’s health and the broader technology sector. As investors navigate the complexities of market conditions, understanding the factors influencing Google’s stock can provide valuable insights. With projected growth in its major sectors, Google remains a key player to watch for those interested in the tech industry’s future. Investors should continue to monitor economic trends and company developments for informed decision-making.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.