Understanding Current Trends in Gold Prices

Introduction

Gold prices are a crucial factor affecting global financial markets, influencing investments and economic stability. With gold being both a safe-haven asset and a luxury good, understanding its price trends is vital for investors, economists, and everyday consumers alike. Recent fluctuations in gold prices, driven by various geopolitical and economic factors, have attracted significant attention.

Current Trends in Gold Prices

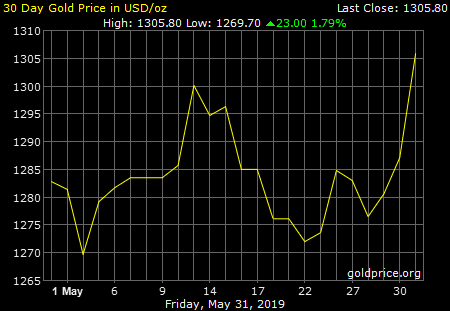

As of October 2023, gold prices have shown a remarkable increase, reaching around AUD 2,800 per ounce, marking a 15% rise over the past year. This surge is attributed to heightened inflation concerns, geopolitical tensions, and changes in central bank policies.

The ongoing conflict in Eastern Europe and rising tensions in the Asia-Pacific region have led many investors to seek safety in gold, historically viewed as a hedge against economic uncertainty. Additionally, inflation rates have remained elevated, prompting investors to diversify their portfolios and increase their allocation in precious metals.

Factors Influencing Gold Prices

Several factors are currently influencing the fluctuations in gold prices:

- Inflation and Interest Rates: Central banks, particularly the Reserve Bank of Australia (RBA), are closely monitoring inflation trends, with markets anticipating future interest rate adjustments. Lower interest rates typically make gold more attractive compared to interest-bearing assets.

- Geopolitical Tensions: The ongoing instability in various parts of the world has created an environment of uncertainty, leading to increased demand for gold as a secure investment.

- Currency Fluctuations: The strength of the Australian dollar against other currencies can also impact gold prices. A weaker AUD generally leads to higher gold prices in AUD terms.

The Future of Gold Prices

Looking ahead, analysts suggest that gold prices may continue to rise if inflation persists and geopolitical tensions escalate. However, fluctuations in the US dollar and potential policy changes by central banks can also create volatility. Investors are advised to keep a close eye on macroeconomic indicators and market trends to make informed decisions.

Conclusion

The significance of gold prices extends beyond the financial markets, impacting economic stability and investor behaviour. As we navigate uncertain times, the demand for gold is likely to remain strong. For investors, understanding the forces driving gold prices can provide valuable insights for financial planning and risk management.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.