Understanding Current Trends in Ethereum Price

Introduction

Ethereum, a leading cryptocurrency after Bitcoin, has gained significant attention due to its potential applications in various sectors, including finance, gaming, and art. The price of Ethereum is a critical indicator that informs investors and users about market conditions and future potential.

Current Market Trends

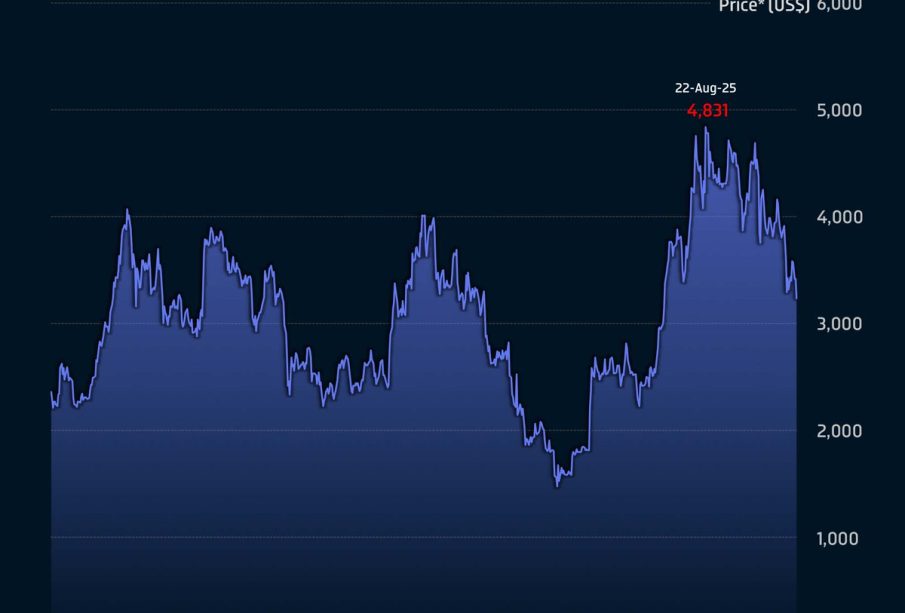

As of October 2023, the Ethereum price has seen considerable fluctuations. Starting the month at approximately AUD 2,600, the cryptocurrency has hit both highs and lows influenced by factors such as market sentiment, regulatory developments, and technological upgrades. Notably, Ethereum’s upgrade to Ethereum 2.0 has prompted increased interest from both institutional and retail investors, which has led to a rise in price.

Market analysts have noted that the price of Ethereum tends to closely follow Bitcoin trends, but it also thrives on its unique attributes, such as its smart contract capabilities that enable decentralized applications (dApps). This month, Ethereum’s price reached a peak of AUD 3,200 before correcting to the current trading level of around AUD 2,900. This volatility showcases the dynamism of the cryptocurrency market.

Driving Factors

Several factors contribute to the current price dynamics of Ethereum. Firstly, the ongoing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) has spurred demand. With Ethereum being the backbone of these technologies, any increase in the usage of DeFi platforms or NFT marketplaces positively impacts its price. Secondly, developments in the broader regulatory environment, particularly in Australia, have created both opportunity and uncertainty, influencing investor behaviour.

Future Outlook

Looking ahead, market experts suggest that the Ethereum price could experience further upward momentum depending on adoption rates and technological advancements, especially concerning scalability solutions like Layer 2. However, potential market corrections due to regulatory news or macroeconomic factors cannot be ruled out. Therefore, it remains crucial for investors to stay informed and consider both market data and broader economic indicators when making investment decisions.

Conclusion

The Ethereum price remains a pivotal element of the cryptocurrency landscape. As advancements in blockchain technology continue and the financial ecosystem evolves, understanding the trends and factors influencing Ethereum’s price will be essential for investors and users alike. The potential for recovery after price drops and the ongoing development in the Ethereum ecosystem suggests that awareness of market conditions will be key for strategic positioning in the future.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.