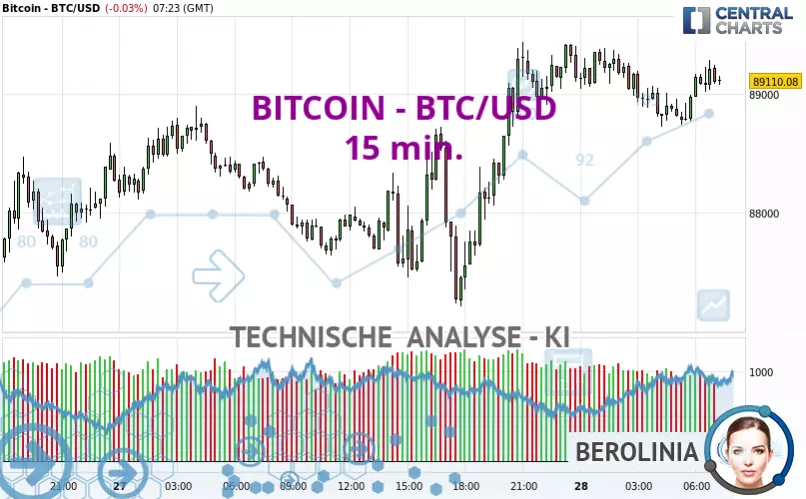

Understanding bitcoin usd: What the BTC–USD Rate Means for Markets

Introduction: Why bitcoin usd matters

The bitcoin usd pair is the primary price quotation connecting the world’s most widely recognised cryptocurrency with the US dollar, the dominant global fiat currency. Tracking bitcoin usd is important for investors, traders and policymakers because it provides a common benchmark for liquidity, market sentiment and cross-border comparisons. Movements in the BTC–USD rate often influence broader digital-asset markets and attract attention from financial media, exchanges and regulators.

Main body: How bitcoin usd is determined and why it moves

Market structure and participants

The bitcoin usd price is formed on cryptocurrency exchanges where buyers and sellers submit orders in USD or USD-denominated stablecoins. Participants include retail traders, institutions, market makers and over-the-counter desks. Liquidity in the pair tends to be concentrated on major exchanges, which together create the reference prices quoted by wallets, price indices and trading platforms.

Key drivers of the BTC–USD rate

Several broad factors affect bitcoin usd: supply and demand for Bitcoin, macroeconomic conditions (including the strength of the US dollar), investor risk appetite, regulatory developments and technological news from the Bitcoin ecosystem. Because Bitcoin has a capped supply, changes in demand can produce significant price swings. Conversely, shifts in the dollar’s value, interest rate expectations or global liquidity conditions can indirectly influence BTC–USD by altering investors’ allocation decisions.

Volatility, risk and trading considerations

Bitcoin usd is known for volatility relative to many fiat currencies and traditional assets. Traders commonly use risk management tools—such as position sizing, stop orders and diversification—to manage exposure. Market participants should also note that exchange-specific factors (order book depth, trading hours and custody arrangements) can cause short-term price discrepancies between venues.

Conclusion: Significance and outlook for readers

For readers, monitoring bitcoin usd offers insight into sentiment around digital assets and the interplay between crypto markets and the US dollar. Short-term movements can be rapid, while long-term trends depend on adoption, regulation and macroeconomic conditions. Those considering exposure to bitcoin usd should weigh volatility, conduct due diligence on trading platforms and align positions with their risk tolerance and investment horizon.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.