Understanding Bitcoin to USD Exchange Rates

The Importance of Bitcoin to USD

Bitcoin has emerged as a pivotal player in the global financial landscape, capturing the attention of investors, financial analysts, and consumers alike. The exchange rate of Bitcoin to USD serves as a key indicator of its overall health and the sentiment surrounding cryptocurrencies. Understanding this relationship is critical, especially as Bitcoin continues to gain traction as a digital asset and a potential hedge against inflation.

Current Market Landscape

As of October 2023, Bitcoin’s price has showcased significant volatility, trading between $25,000 and $34,000 in recent months. This fluctuation has been influenced by a variety of factors, including macroeconomic trends, regulatory news, and the increasing adoption of cryptocurrencies as a legitimate financial instrument.

In the previous quarter, Bitcoin hit a peak of approximately $35,000 before experiencing a correction due to profit-taking by investors and concerns over potential regulatory crackdowns in various countries. However, the resilience of Bitcoin, evidenced by subsequent rebounds, has been noted by analysts as a sign of growing institutional interest.

Factors Influencing Bitcoin’s Value Against the USD

Several factors contribute to the fluctuations in the Bitcoin to USD exchange rate:

- Market Demand: As more individuals and institutions seek to invest in Bitcoin, demand drives up its price against the USD.

- Regulatory Developments: News regarding cryptocurrency regulations can lead to market anxiety or confidence, impacting Bitcoin’s value.

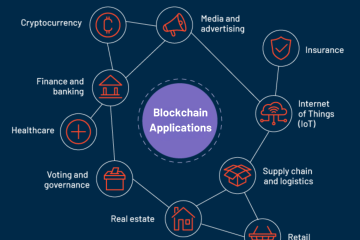

- Technological Advances: Innovations and improvements in blockchain technology can enhance Bitcoin’s utility and attractiveness as an investment.

- Macroeconomic Trends: Global economic conditions, particularly in relation to inflation and fiscal policies, can drive investors towards Bitcoin as a store of value.

Outlook on Bitcoin to USD

The outlook for Bitcoin against the USD remains mixed, but many experts predict that as more institutional players enter the market, Bitcoin could achieve price stability that reflects its value as a digital asset. Analysts suggest that the price could potentially see new highs in the next 12-18 months, particularly if macroeconomic conditions favor cryptocurrency investments.

In conclusion, understanding Bitcoin’s relationship with the USD is essential for investors and enthusiasts alike. While predicting market movements remains challenging, staying informed about developments will be key to navigating this dynamic landscape.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.