Understanding Bitcoin Price Trends in 2023

Introduction

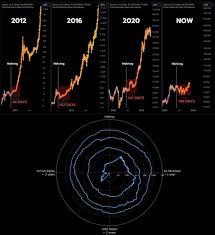

The price of Bitcoin has garnered significant attention from investors and analysts alike as it influences and reflects the broader cryptocurrency market. As of October 2023, Bitcoin’s price trends have showcased not only its resilience but also its volatility. Understanding the movements in Bitcoin price is crucial for anyone participating in the cryptocurrency market, whether they’re seasoned investors or newcomers looking to explore this digital asset.

Current Trends and Factors Affecting Bitcoin Price

As per CoinMarketCap, Bitcoin’s price experienced a series of fluctuations in recent weeks, hovering around AUD 40,000 to AUD 45,000. This range has seen a resurgence after a notable dip earlier in the year, where Bitcoin’s value dropped to approximately AUD 30,000. Analysts point out several factors contributing to this recent increase in price, including heightened institutional interest and a bullish market sentiment following recent regulatory clarifications.

The potential approval of Bitcoin exchange-traded funds (ETFs) in several countries is also seen as a pivotal element driving the current price surge. With institutional investors waiting on the sidelines for regulatory clarity to participate, analysts suggest that the approval could lead to substantial inflows into Bitcoin and further solidify its status as a mainstream asset class.

Economic Impact and Future Predictions

Global economic conditions, including inflation rates, interest rate changes, and geopolitical tensions, have a direct impact on Bitcoin’s price. In times of economic uncertainty, many investors view Bitcoin as a hedge against inflation, which has contributed to its appeal as a long-term investment. As governments continue to grapple with economic challenges, the prospect of Bitcoin’s price rising may remain a distinct possibility.

Looking ahead, experts are divided on what the future holds for Bitcoin prices. Some analysts predict a bullish market, forecasting that Bitcoin could reach AUD 60,000 by the end of the year, citing increased adoption and potential new regulatory frameworks. Conversely, others remain cautious, highlighting the inherent volatility of cryptocurrencies and the potential for sudden market corrections.

Conclusion

The significance of understanding Bitcoin price trends is paramount for anyone involved in the cryptocurrency space. As Bitcoin continues to evolve and adapt to changing market dynamics, staying informed about its price movements and the factors influencing them is key to making sound investment decisions. Whether Bitcoin solidifies its place as a financial mainstay or experiences further volatility, its journey remains one of the most significant stories in modern finance.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.