Understanding ANZ Banking: Recent Developments and Future Trends

Introduction

ANZ Banking Corporation, one of Australia’s largest financial institutions, plays a crucial role in the economy by providing a range of banking and financial services to individuals, businesses, and communities. The significance of ANZ in the Australian banking landscape cannot be understated, particularly in light of recent developments that have shaped its operations. Understanding ANZ’s current initiatives and challenges is essential for consumers and investors alike, as they reflect broader trends within the banking sector.

Recent Developments

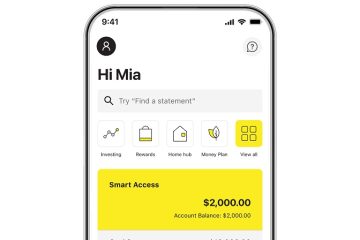

Recently, ANZ has taken significant steps towards enhancing its digital banking offerings. During Q3 2023, the bank announced the expansion of its mobile app services, aiming to provide customers with a more user-friendly interface and increased functionalities. This move aligns with the growing demand for digital solutions amid changing consumer preferences.

Moreover, ANZ has been actively involved in promoting sustainability within its operations. In September 2023, the bank committed to achieving net zero emissions by 2050, aligning with Australia’s broader goals for climate action. This initiative involves significant investments in renewable energy projects and sustainable finance, seeking to lead the industry in environmental responsibility.

Challenges Facing ANZ

Despite promising developments, ANZ faces several challenges. The banking sector is currently navigating a complex economic environment influenced by rising interest rates and inflationary pressures. As of October 2023, the Reserve Bank of Australia has maintained a tight monetary policy to combat inflation, which may influence lending practices and consumer behaviour.

Additionally, competition in the financial sector has intensified, with new fintech companies offering innovative solutions that attract younger consumers. Traditional banks like ANZ must adapt quickly to remain competitive amidst the evolving landscape.

Looking Ahead

As the financial landscape continues to evolve, ANZ’s focus on digital transformation and sustainability will be critical for its future success. Analysts predict that the bank’s efforts to innovate and adapt to market changes will position it well against competitors. The commitment to environmental, social, and governance (ESG) principles is expected to resonate positively with consumers seeking responsible banking options.

Conclusion

In summary, ANZ Banking Corporation is at a pivotal point, balancing opportunities for growth with challenges posed by a dynamic financial environment. The bank’s strategies in digital banking and sustainability will play a significant role in shaping its future. As consumer expectations shift and regulatory pressures evolve, ANZ’s ability to adapt will be essential for its long-term success, making it a key player in Australia’s banking sector.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.