Understanding Amazon Share Price Trends in 2023

Introduction

The share price of Amazon, one of the world’s leading e-commerce and cloud computing companies, is a key indicator of financial health and market sentiment. Investors closely monitor its performance due to its influence on global market trends. As of late 2023, fluctuations in Amazon’s share price highlight various economic factors, making it crucial information for potential and current investors.

Current Performance of Amazon Shares

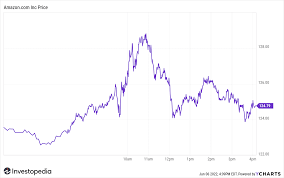

As of October 25, 2023, Amazon’s share price stands at approximately AUD 150, reflecting a significant recovery from earlier declines earlier this year. The company’s stock is experiencing a robust upward trend, following strong quarterly earnings reports that exceeded analysts’ expectations. This rebound comes after a challenging period in 2022, where inflationary pressures and supply chain disruptions had adversely affected sales.

Factors Influencing Share Price

Several key factors have contributed to the current price level of Amazon shares:

- Strong Earnings Reports: Amazon’s recent quarterly earnings have shown a year-on-year increase in revenue, primarily driven by its AWS (Amazon Web Services) segment and a resurgence in retail sales.

- E-commerce Growth: The e-commerce sector continues to expand post-pandemic, with more consumers choosing online shopping. Amazon’s initiatives in improving customer experience and logistics have paid off significantly.

- Technological Innovations: Investments in artificial intelligence and machine learning technologies are enhancing Amazon’s operational efficiency and customer engagement, attracting positive investor sentiment.

Future Outlook

Looking ahead, analysts project that Amazon will continue to strengthen its market position, with expected share price growth driven by expanded service offerings and international markets. However, potential risks remain including regulatory scrutiny and competition from other e-commerce players.

Conclusion

For investors and market enthusiasts, monitoring Amazon’s share price is essential due to its broader implications on the technology and retail sectors. Keeping an eye on quarterly performance and external economic factors will provide insights into future movements. As the market evolves, Amazon’s ability to adapt will be key. Overall, while current trends are promising, the volatility of the financial markets necessitates a cautious approach to investment in Amazon shares.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.