Tom Elliott on Australia Property Prices: Current Trends and Insights

Introduction: Understanding the Landscape of Australia Property Prices

Australia’s property market has long been a topic of discussion among economists, investors, and home buyers alike. With the ongoing fluctuations in property prices, understanding the insights from expert commentators like Tom Elliott has become more critical than ever. Elliott, a renowned financial commentator and the host of the Drive program on 3AW, has recently shared his perspectives on the current trends impacting Australian property prices, making it essential for potential buyers and investors to consider his insights.

Current Trends in Australia Property Prices

As of late 2023, property prices in Australia have exhibited mixed patterns. According to recent data from CoreLogic, national dwelling prices have shown a decline of approximately 1.5% over the last quarter. However, this average hides significant variations across different regions and property types. Tom Elliott has pointed out that the capital cities are experiencing distinct patterns compared to regional areas, with Sydney and Melbourne continuing to show resilience in their pricing, while smaller towns might be experiencing more downward pressure.

Factors Influencing Property Prices

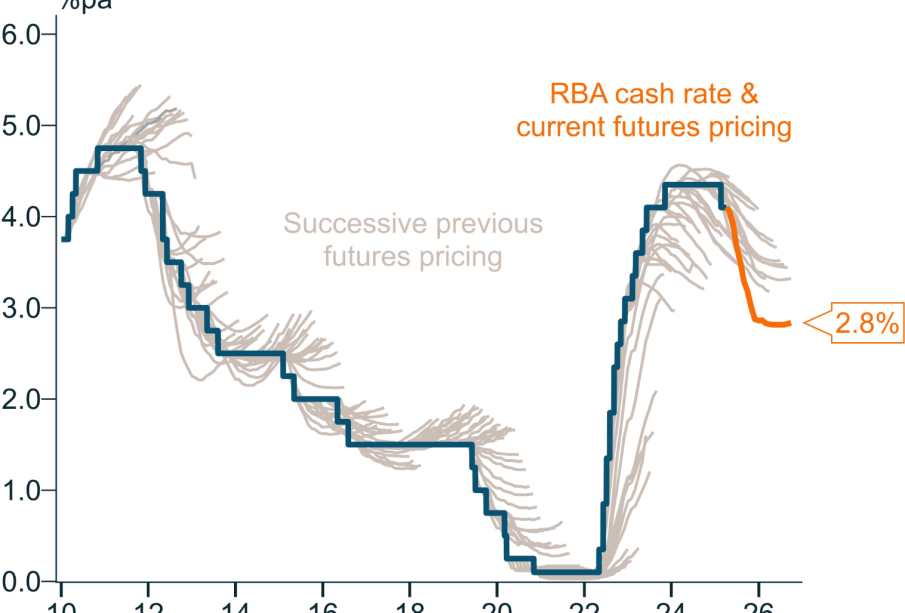

Elliott identifies several factors influencing these dynamics. Firstly, interest rates play a pivotal role. As the Reserve Bank of Australia has gradually increased rates to combat inflation, borrowing costs have risen, thereby impacting buyer sentiment and affordability. Tom emphasizes that cautious consumers are now considering their purchases more carefully, often leading to longer selling times and potential price reductions in some areas.

Additionally, the supply chain issues experienced during the pandemic have contributed to delays in construction, leading to a shortfall in new housing stock. Elliott argues that this limited supply in some markets is countering the price decline we might expect amid higher interest rates, resulting in a complex landscape where certain property segments remain competitive.

Conclusion: The Future of Australia Property Prices

In conclusion, Tom Elliott’s analysis of Australia’s property prices highlights a crucial juncture for buyers and investors. While uncertainty remains in the market, the interplay of interest rates, supply chain issues, and regional demand offers a mixed outlook. Potential buyers must carefully navigate these trends, informed by expert insights, to make prudent decisions moving forward. As the market evolves, staying attuned to commentary from experts like Elliott will be increasingly relevant for understanding this dynamic sector of the Australian economy.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.