The Nasdaq Index: Importance and Current Trends

Introduction

The Nasdaq Index is one of the most crucial stock market indices in the world, representing a significant portion of global technology and growth companies. As a benchmark for technology stocks, it provides insights not only into the performance of major tech companies but also reflects broader economic trends. Understanding the Nasdaq Index is essential for investors, analysts, and anyone interested in the financial markets.

What is the Nasdaq Index?

The Nasdaq Index includes over 3,000 publicly traded companies, with a heavy weighting towards technology firms such as Apple, Microsoft, and Alphabet (Google’s parent company). The index was launched in 1971 and became the world’s first electronic stock market. Since then, it has evolved into a key barometer for the performance of technology and growth-oriented companies.

Recent Trends in the Nasdaq Index

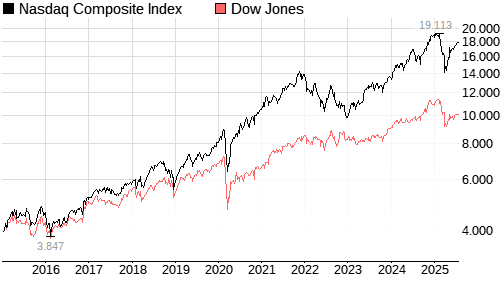

The Nasdaq Index has seen significant fluctuations in recent months, particularly influenced by factors such as inflation rates, interest rate adjustments by the Federal Reserve, and geopolitical tensions. As of October 2023, the index is experiencing a period of volatility, with tech stocks facing pressure from rising interest rates. Many analysts warn that elevated valuations in the technology sector could lead to corrections. However, optimistic forecasts for artificial intelligence and green technology continue to draw investor interest.

Impact on Investors

For investors, understanding the dynamics of the Nasdaq Index is crucial for making informed decisions. The index’s performance can signal trends that impact both individual and institutional investing strategies. Positive earnings reports from key tech companies often lead to a surge in the index, while negative news can have the opposite effect. Long-term investors often view dips in the Nasdaq Index as potential buying opportunities, while short-term traders may capitalize on volatility.

Conclusion

The Nasdaq Index remains a pivotal part of the financial landscape, representing innovation and growth in the technology sector. While current market conditions present challenges, the potential for long-term growth in technology remains a compelling factor for many investors. As global economic conditions evolve, the Nasdaq Index will continue to be a key indicator of market sentiment and investment opportunities.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.