The Nasdaq 100: An Overview and Recent Developments

Introduction

The Nasdaq 100 index is one of the most influential stock market indices in the world, representing the largest non-financial companies listed on the Nasdaq stock exchange. As a benchmark for technology and growth companies, the Nasdaq 100 is crucial for investors seeking to understand market trends, particularly given its heavy weighting toward technology firms. Its performance is often a reflection of innovations and shifts occurring within the tech sector, making it a significant focus for both traders and long-term investors.

Current Performance and Trends

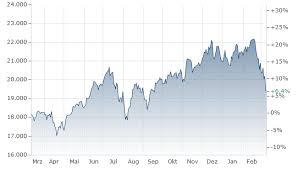

As of late October 2023, the Nasdaq 100 has shown remarkable resilience, rebounding from earlier fluctuations caused by inflationary pressures and interest rate hikes. Recent reports indicate the index is up approximately 25% year-to-date, outperforming many traditional indices like the S&P 500 and the Dow Jones Industrial Average. This surge has largely been driven by gains in tech giants such as Apple, Microsoft, and Nvidia, whose advancements in artificial intelligence and semiconductor technology continue to attract investor interest.

In the third quarter of 2023, several companies within the Nasdaq 100 reported strong earnings, further propelling the index upward. The earnings growth came amid fears of an economic slowdown, demonstrating that tech and growth stocks can thrive even in the face of economic uncertainty. Analysts expect this trend to continue, especially as companies progressively adopt AI solutions to enhance productivity.

The Role of Interest Rates

One vital factor influencing the Nasdaq 100 is the ongoing Federal Reserve policies regarding interest rates. Following a series of rate hikes in 2022, discussions around the potential for stabilizing rates have caused fluctuations in market sentiment. Lower rates tend to benefit tech stocks, as they lower borrowing costs and improve potential profit margins. As the Fed indicated a more cautious approach towards further rate increases, many investors view this as bullish for the technology sector, particularly those represented in the Nasdaq 100.

Conclusion

The Nasdaq 100 remains a pivotal element of the global investment landscape, reflecting both the potential and risks inherent in technology and growth sectors. For investors, understanding the index’s movements provides key insights into broader economic trends. Looking ahead, analysts forecast that the continued advancements in technology and increasing adoption of innovative solutions will likely keep the Nasdaq 100 in a favorable position, attracting further investment, especially if interest rates stabilize. Thus, monitoring this index can offer critical insights for investors looking to navigate the complex economy of 2024 and beyond.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.