The Influence of Trump on Interest Rates: What You Need to Know

Introduction

The influence of former President Donald Trump on interest rates remains a hot topic among economists and policymakers. Trump’s term was marked by significant changes in fiscal policy, tax cuts, and an aggressive approach toward the Federal Reserve, which has continued to resonate in today’s economy. Understanding the implications of these interest rate shifts is crucial for investors, homebuyers, and everyday consumers as they navigate the current financial landscape.

Trump’s Policies and Their Impact

During his presidency, Trump often pushed for lower interest rates, arguing that they would stimulate the economy and encourage borrowing. He publicly criticized the Federal Reserve for what he perceived as unnecessarily high rates. In 2018, he stated, “The Fed is making a mistake. They’re so tight. I think the market is going to correct.” His administration also implemented significant tax cuts, which aimed to boost investment and consumption. These moves initially led to a stock market surge and a decline in unemployment rates. However, they also raised concerns about inflation and economic overheating.

Current Interest Rate Trends

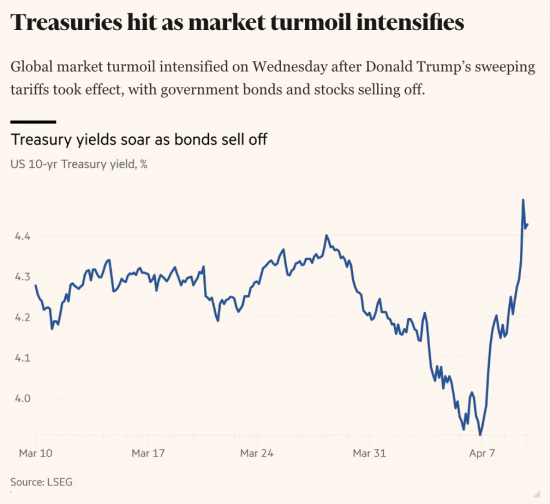

As of October 2023, the impacts of Trump’s economic policies are still evident. The Federal Reserve has kept interest rates relatively high to combat inflation stemming from post-pandemic recovery efforts and supply chain disruptions. Recent reports indicate that the benchmark interest rate in the U.S. remains above 5%, contributing to increased borrowing costs for consumers and businesses alike. This situation is further complicated by geopolitical concerns and ongoing economic uncertainty worldwide, which keeps investors on edge.

The Australian Perspective

In Australia, rising interest rates in the U.S. often lead to corresponding changes in the Reserve Bank of Australia’s monetary policy. With global economic interconnectedness, Australian borrowers feel the effects of U.S. interest rate decisions. As such, decisions made under the influence of Trump’s economic legacy can ripple through to the Australian economy, impacting home loans, business investments, and consumer spending.

Conclusion

The interplay between Trump’s policies and interest rates plays a significant role in shaping economic conditions both in the U.S. and abroad. As we move forward, it will be critical to monitor how these dynamics evolve in response to global monetary policy, especially as central banks navigate the delicate balance between inflation control and economic growth. For readers and investors, staying informed about these trends is vital, as the reverberations of past administrations continue to influence today’s financial environment.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.