The Importance of the S&P 500 Index in 2023

Introduction

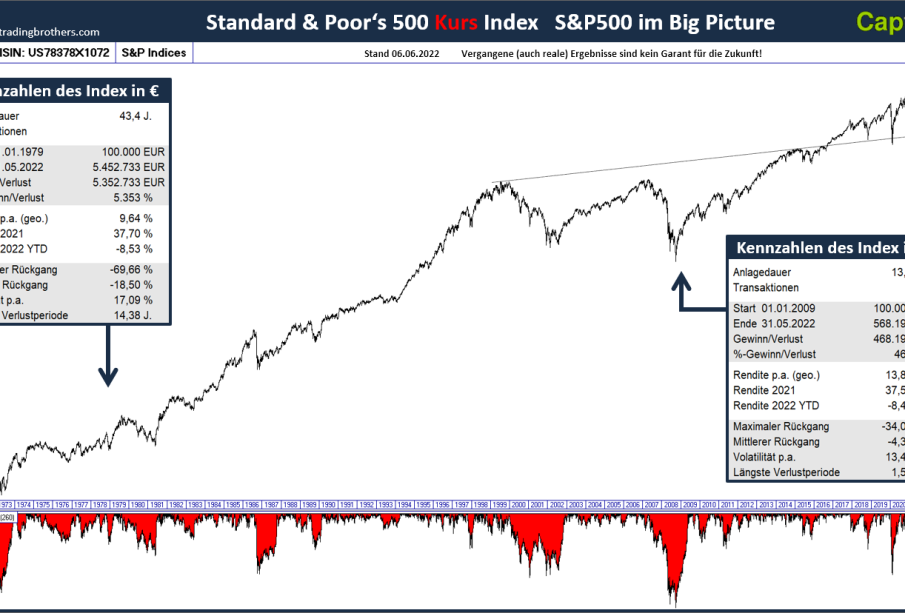

The S&P 500, or Standard & Poor’s 500, is a stock market index that tracks the performance of 500 of the largest companies listed on stock exchanges in the United States. As one of the most commonly followed equity indices, it serves as a key benchmark for investors and a reflection of the overall health of the U.S. economy. In a time of economic uncertainty and fluctuating market conditions, understanding the S&P 500’s performance and significance is more pertinent than ever.

Current Trends and Performance

As of October 2023, the S&P 500 index has shown resilience amidst a backdrop of rising interest rates and ongoing inflationary pressures. After closing at a 52-week low earlier this year, the index has rebounded, gaining approximately 16% year-to-date. Much of this recovery can be attributed to strong earnings reports from key technology companies, which form a significant portion of the index. Household names such as Apple, Microsoft, and Amazon have driven up investor confidence and attracted renewed buying interest.

Additionally, recent market analyses indicate that the index is emerging from a consolidation phase, which may build momentum heading into the end of the year. Investment strategies focusing on sectors that traditionally outperform in recessionary environments, like consumer staples and healthcare, have gained traction. Financial analysts suggest the S&P 500 could continue to experience volatility but may find stability as the economic landscape adapts to new market conditions.

Global Context and Future Outlook

Globally, the S&P 500 also influences markets beyond the U.S. As multinational companies within the index operate in various regions, their performance can affect foreign markets and investor sentiment worldwide. For instance, any economic shifts or policy changes in the U.S. directly influence global stocks, making the S&P 500 a vital player on the international stage.

Going forward, analysts recommend keeping a close eye on Federal Reserve announcements concerning interest rates, as these could impact borrowing costs and consumer spending, both critical to corporate growth. Market forecasts suggest that if inflation continues to moderate and economic growth remains stable, the S&P 500 could potentially reach new highs in the coming quarters.

Conclusion

The S&P 500 index remains a crucial indicator of market health in 2023, providing insights not only into the American economy but global financial trends as well. Investors should remain vigilant, aligning their strategies with ongoing changes in the economic climate. With many variables at play, the significance of this index cannot be understated as it represents both a gauge of performance and a predictive tool for future market movements.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.