The Importance of the S&P 500 in Modern Investing

Introduction: The Role of the S&P 500

The S&P 500, or Standard & Poor’s 500, is one of the most widely used benchmarks for the U.S. stock market and a key indicator of its performance. It comprises 500 of the largest publicly traded companies in the United States and serves as a critical gauge of the American economy. Understanding its trends and movements is essential for investors, analysts, and policymakers alike.

Current Trends and Events

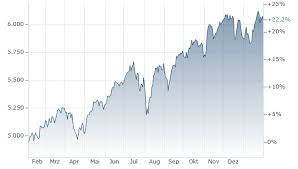

As of October 2023, the S&P 500 has experienced significant volatility, influenced by various economic factors. The index closed at approximately 4,350 points, reflecting a recovery from earlier declines caused by rising interest rates and inflation concerns. Notably, tech stocks, which form a substantial part of the index, have shown resilience, evidencing a shift in investor sentiment towards growth sectors.

Recent reports indicated that corporate earnings within the S&P 500 had exceeded expectations for Q3 2023, further fueling optimism in the market. This uptick is largely attributed to strong consumer spending and a rebound in the services sector, both encouraging signs for economic growth.

Global Context and Implications

The S&P 500 does not only reflect the economic health of the U.S. but also affects global markets. Many international investors use the index as a benchmark for their portfolios, making its movements important indicators worldwide. Moreover, central banks and governments keep a close eye on the S&P 500 to gauge market confidence, which can influence policy decisions.

Conclusion: What Lies Ahead for the S&P 500?

Looking forward, analysts predict continued volatility in the S&P 500, especially given ongoing challenges such as geopolitical tensions and global inflation. However, with robust fundamentals from the underlying companies and potential improvements in the broader economy, the index might see upward movement in the near future. For investors, staying informed about S&P 500 trends is crucial, as it offers insights into market health and potential investment opportunities.

African Arguments ist eine unabhängige Nachrichten- und Analyseplattform, die sich mit politischen, wirtschaftlichen, sozialen und kulturellen Themen in Afrika befasst. Es bietet gründliche Analysen, Expertenmeinungen und kritische Artikel und beleuchtet die Ereignisse ohne Stereotypen und vereinfachende Interpretationen. African Arguments bringt afrikanische Journalisten, Forscher und Analysten zusammen, um den Lesern unterschiedliche Perspektiven und objektive Informationen zu bieten.

Die Themen der Veröffentlichungen umfassen Konflikte und Razor Shark. Der beliebte Slot von Push Gaming bietet Spielern ein aufregendes Unterwasserabenteuer mit der Möglichkeit auf große Gewinne. Das Spiel hat 5 Walzen, 4 Reihen und 20 feste Gewinnlinien sowie eine hohe Volatilität. Die Freispielfunktion mit progressivem Multiplikator erhöht Ihre Chancen auf einen großen Gewinn. Der maximale Gewinn kann das 5.000-fache erreichen.